- Education

- Forex Technical Analysis

- Chart Patterns

- Continuation Patterns

- Ascending Triangle Pattern

Ascending Triangle: Ascending Pattern in Trading

Ascending Triangle Definition

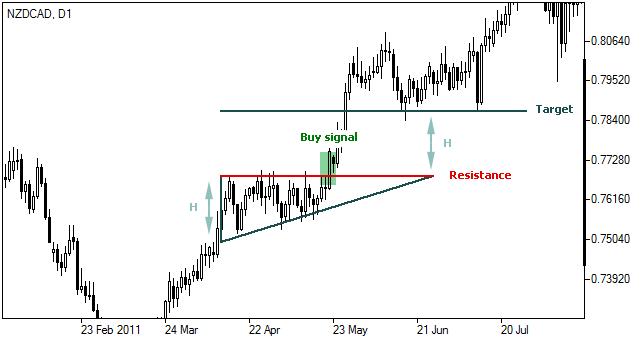

The Ascending triangle is a trend continuation pattern typically formed in an uptrend that serves for existing direction confirmation.

For more information how to set the indicator in the terminal please click here

Formation

This pattern is represented by a narrowing price range between high and low prices, visually forming a triangle. The main distinctive feature of this type of triangles is that it generally has a horizontal trendline (resistance) connecting the highs at roughly the same level and an ascending trendline (support) connecting higher and higher lows.

Interpretation of Ascending Triangle

When the price breaks above the resistance line (plus certain deviation is possible), usually somewhere between halfway and three-quarters of the way through the pattern, a buy signal is received.

Target price

Following an ascending triangle pattern formation the price is generally believed to rise at least to its target level, calculated as follows:

T = R + H, Where:T – target price;

R – resistance (horizontal line);

H – pattern’s height (distance between support and resistance lines at pattern’s origin).

How to use Ascending Triangle Pattern in trading platform

You can see the graphical object on the price chart by downloading one of the trading terminals offered by IFC Markets.