- Education

- Forex Technical Analysis

- Chart Patterns

- Reversal Patterns

- Inverse Head and Shoulders

Inverse Head and Shoulders: Forex Chart Pattern

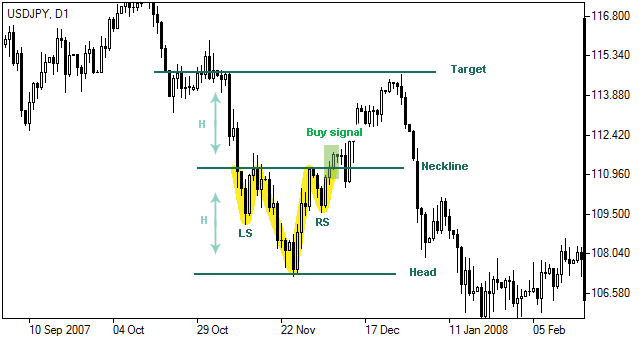

The inverse head and shoulders graphical price pattern serves as a sign of trend reversal and is expected to be followed by change in direction of the asset’s price. It is typically formed in a developed downtrend.

Formation

The pattern is characterized by three consecutive lows of the market price located at different levels: two higher bottoms (shoulders) aside and one lowest bottom (head) in between. There is also a neckline ( resistance) connecting pattern’s highs.

Interpretation of Inverse Head and Shoulders

When the pattern is formed and the price climbs above the neckline or resistance level (plus a certain deviation is possible), investors get a buy signal. The expectation is that the rally will continue, although prices may rebound to the neckline, considered now a support, but generally stop around it.

Target price

Following inverse head and shoulders pattern formation the price is generally believed to rise at least to its target level, calculated as follows:

T = N + (N – H), Where:T – target level;

N – neckline level (initial resistance);

H – pattern’s head level (lowest bottom).

Not sure about your Forex skills level?

Take a Test and We Will Help You With The Rest

You can see the graphical object on the price chart by downloading one of the trading terminals offered by IFC Markets.