- Innovations

- Portfolio Quoting Method

Portfolio Quoting Method: Unlimited Trading Instruments

Portfolio Quoting Method (GeWorko) - is an innovative approach to study of financial markets and analysis of their dynamics. In fact, it is based on Forex concept, according to which, one financial asset is quoted by another. According to this method, the concept is expanded for portfolios that stand for base and quoted parts. More precisely saying, one combination of assets is quoted by another combination.

Only with IFCM Group you can create and trade new financial instruments from a variety of available assets.

Advantages of Portfolio Quoting Method:

Personal composite instruments, created by this Method, are used for analyzing financial markets, studying complex interrelations between assets and their combinations on historical charts. Moreover, traders instantenously obtain the opportunity for trading the created instruments.

- Create and trade your own unique instruments, which are stable to the volatility of the markets for a long period of time

- Compose and trade positional portfolio (consisting of long and short positions) and make its graphical analysis

- Simplify portfolio rebalancing: analysis and rebalancing of the portfolio is integrated in the trading platform

- Analyze deep price history of the created instruments both in absolute terms and in relation to any other asset or portfolio

- Build both simple and complex portfolios, including dozens of financial asset

- Quote one portfolio (base portfolio) in the units of another (quoted portfolio)

0+ New

Instruments and Indices

- Use different trading strategies like Pair trading/Spread trading, arbitrage trading, etc

- Ideal opportunity for looking at market trends from a different angle. Analyze different markets, its segments or world markets’ relationships with powerful analytical tool

- Scalability, flexibility and universality which open up new horizons for analysis and trading

- 1 EUR / DJI

- 2 XAU / AUD

- 3 CORN / SOYB

- 4 APPLE+GOOGLE / DJI

- .

- .

- .

- n AA+DIS+GE / KO+JPM+MCD

FAQ for the users of Portfolio Quoting Method

Portfolio Quoting Method (GeWorko)is a method of creating and trading a new class of synthetic instruments called in NetTradeX terminal Personal Composite Instruments (PCI). This synthetic instrument is created from the available financial instruments. The concept of the new class of instruments is fully based on Forex trading, where trading instruments are composed of B/Q parts.

However, the new class of instruments, being based on this concept has a significant distinction - instead of single assets in both base and quoted parts these new instruments are composed of base and quoted portfolios. The portfolios can contain instruments from completely different classes - currencies, stocks from different markets, indexes, commodities, and many more. This means that each part can contain not only more than one asset, but also assets from various financial sectors. Moreover, each component asset has an individual weight in the total structure of the instrument, whiNevertheless, investors may prefer creating instruments containing only one currency in each part of the instrument which makes the PCI a standard currency pair (as usual, a new cross rate).

The physical explanation of the PCI=P1/P2 is exchange rate of one financial portfolio expressed in the units of another portolfio.

The method is primarily for the analysis of financial markets, the study of complex interrelations between assets and their combinations. The method provides convenient technology for technical analysis of complex asset portfolios, the study of the behavior of portfolios, based on historical data. Absolute flexibility of the method and its practical implementation on NetTradeX trading platform are achieved by giving each asset an individual weight in the total structure, including both long and short positions in the portfolio, using hundreds of different asset classes.

The method allows the trader to realize his trading ideas and strategies by personal composite instruments, to check the behavior of his instruments, based on long-term historical data, to find the optimal ratio of the projected profitability and risk tolerance.

Application of Portfolio Quoting Method in practice allows you not only to quickly transfer your ideas to trading-analytical system and to estimate them based on historical data, but also to trade created personal instruments – you can find the details of trading realization on Synthetic instruments page. In fact, the trader is not restricted by the number of available financial instruments any longer, getting an opportunity to create personal instruments, reflecting his own trading ideas and having its graphical history. The method allows to turn two asset portfolios into a new trading instrument, but there is a great variety of such compositions. As a result, practically unlimited number of new instruments for analysis and trading become available for the trader.

One can ask if I am already trading one instrument why I would need to create unlimited number of instruments. The short answer is - having ability to create unlimited number of instruments opens limitless opportunities for a trader to make analysis and realize own trading strategies. Of course, this method will be more applicable for professional traders that are utilizing their strategies and are looking for a unique niche rather than following recommendations of others.

However, the interface is so user friendly that anybody can get used to trading it. However, for them it is highly recommended to use demo account (practice account) with IFC Markets at first, which is free and is a good start for those who do not want to take risks without understanding the new technology.

We are not suggesting, not even expecting, that every trader should have or should trade synthetic instruments, it is more about the opportunities providing competitive advantages for traders. Traders differ from each other by their preferences and that is why the methods and tools provided by the company are absolutely flexible and universal, which result in addressing requirements and expectations of each and every trader.

It is important to clarify a very strong claim related to “analyzing and trading unlimited amount of trading instruments”.

For example, let us consider 10 different combinations of assets (from different instrument classes, i.e. currency pairs, stocks, commodities, indexes, etc.) and 100 varying weight possibilities for each component. The possible combinations of portfolios to be created is 10100 .This is known as Googol number. Now imagine if we were talking about 100 of instruments. What combinations we would have? Let us not forget that we have these combinations both in base and quote parts of the instrument, thus we can clearly see that we are talking about unlimited combinations of assets - 100100.

The Portfolio Quoting Method is integrated in the Professional Trading Platform NetTradeX. It allows not only creating unlimited number of trading instruments for analyzing market trends, but also allows trading these synthetic instruments just with a single click on the chart of the instrument.

There is no any restriction on creating instruments, it merely depends on traders’ taste and preferences. Moreover, traders have a powerful tool of graphical and mathematical analysis of the newly created instruments which allows performing deep analysis of specific market segments or the whole market itself.

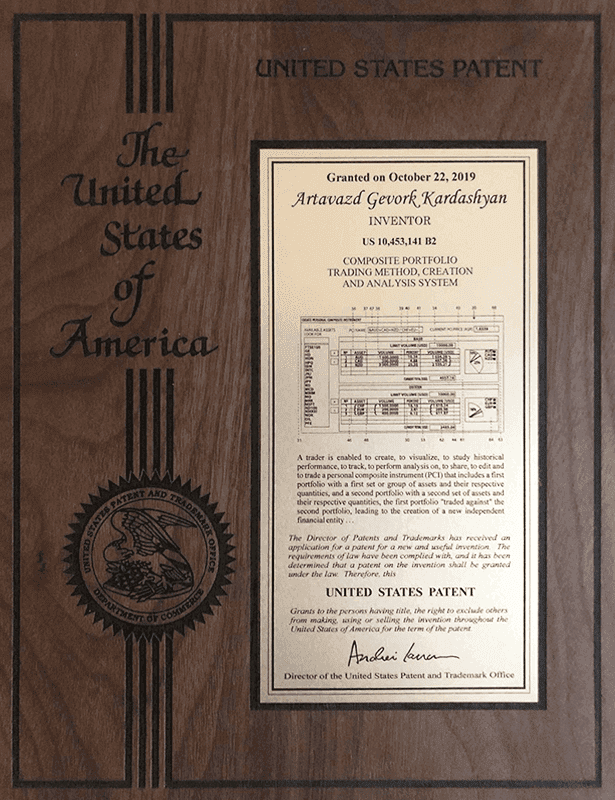

The Portfolio Quoting Method (GeWorko) was developed by IFCM Group, which is a sole proprietor of the method, so traders can only use the method within the companies of IFCM Group. It is important to note that the method is available only on professional trading platform NetTradeX.

IMPORTANT: While IFC Markets offers MetaTrader Platform for regular trading Forex, Stocks, Commodity, Indexes, Portfolio Quoting Method and its implementation are not available there. It is due to the architectural and design limitation of MetaTrader platform.

The concept of Portfolio Quoting Method is similar to currency exchange rate, when the value of the base currency is expressed in units of the quoted one, but in this method the base and the quoted currencies are replaced by two combinations of assets or two portfolios. The sum of the values of all assets in each portfolio, taking into consideration weight coefficients, gives an absolute dollar-denominated value to it. When comparing the value of the portfolio in the base part with that in the quoted part, the method calculates a ratio, which is considered to be the “price” of the new composite instrument and can be interpreted as the value of the base portfolio, expressed in units of the quoted one. Here it is assumed that all used assets have a value, expressed in US Dollars (or just converted into USD).

For the practical application of Portfolio Quoting Method a technology, called Personal Composite Instrument (PCI), has been developed. The technology is implemented on NetTradeX trading terminal as a convenient interface for creating, modifying, reflecting on the charts and trading PCI.

In the process of creating a personal instrument by combining assets, portfolios B (base) and Q (quotation) are created:

Ai- asset i of portfolio B

Vi- volume, number of units of the asset i in portfolio B.

K- number of assets in portfolio B

Аj- asset j of portfolio Q

Vj- volume, number of units of the asset j in portfolio Q.

N- number of assets in portfolio Q

PCI, created by Portfolio Quoting Method, can be presented by the following equation:

In order to calculate the value of PCI at a particular moment in time T it is necessary to carry out the calculation according to the following formula:

- value per unit of asset j in portfolio Q at the moment T, expressed in USD

The study and practice show that the application of Portfolio Quoting Method can be exclusively useful for various ideas and investment strategies. We will bring only a few of possible examples of its application below (from simple to complex).