- Education

- About Forex

- Japanese candles: All genius is simple

Japanese Candlestick - Japanese Candlestick Trading

Japanese candlesticks are the most popular way to read price movements on charts. They are visual, easy to learn, and most importantly, they work.

Candlestick charts provide much more information than line charts and are today's preferred market analysis tool for traders and investors.

KEY TAKEAWAYS

- Japanese candlesticks are the most popular way to read price movements on charts. They are visual, easy to learn, and most importantly, they work.

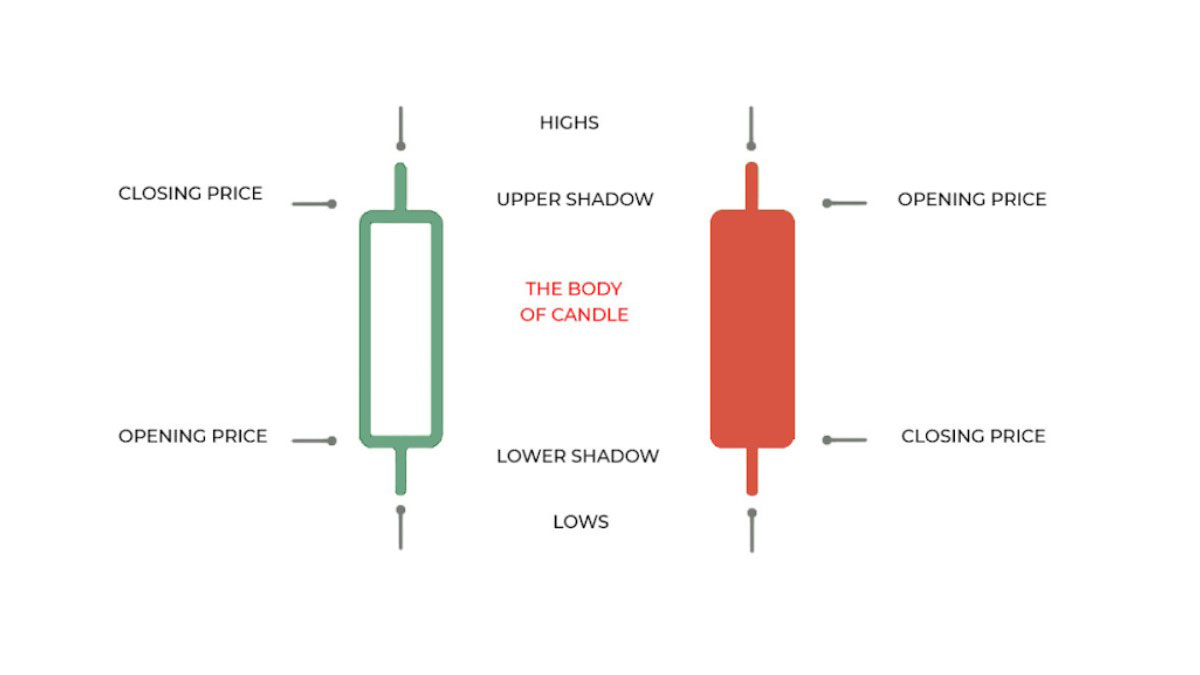

- Each of the candles tells us four facts about itself: the opening price, the low price point, the closing price, and the high price point.

- Each of the candles is an indicator of who is winning the battle between bulls and bears.

What are Japanese Candlesticks

Each of the candles tells us four facts about itself: the opening price, the low price point, the closing price, and the high price point.

- A bullish candlestick is formed when the price rises. In financial markets, the term bullish means going long or buying.

- A bearish candle is formed when the price falls. In financial markets, the term is bearish to go short or sell.

The body of a candle is the space between the open and close of the candle. If the body is green, it means that the closing price of the candle is higher than the opening price. If the color is red, then the closing price is lower than the opening price of the candle.

Candle shadows represent the highest or lowest points that a candle has reached.

For example, you are looking at the EURUSD price chart. The candle opens at 1.0739 and rises 37 pips to close at 1.0776. The color of the candle will be green. If the price falls 37 pips to close at 1.0702, the color of the candle will be red.

Each candlestick represents a timeframe of our choice or a time period during which it opens and closes. For example, on a 4-hour chart, candles open and close every 4 hours.

If we plot multiple candles, we can compare them to a line chart. Candle shadows also show price fluctuations. Thus, we immediately get the maximum information that we need for effective market analysis. This is why Japanese candlesticks are mostly used for technical analysis these days.

Japanese Candlesticks Look Neutral at the Very Beginning

The line is a new candle that looks neutral at the very beginning. It has yet to move up or down. Traders cannot know for sure what the candle will be.

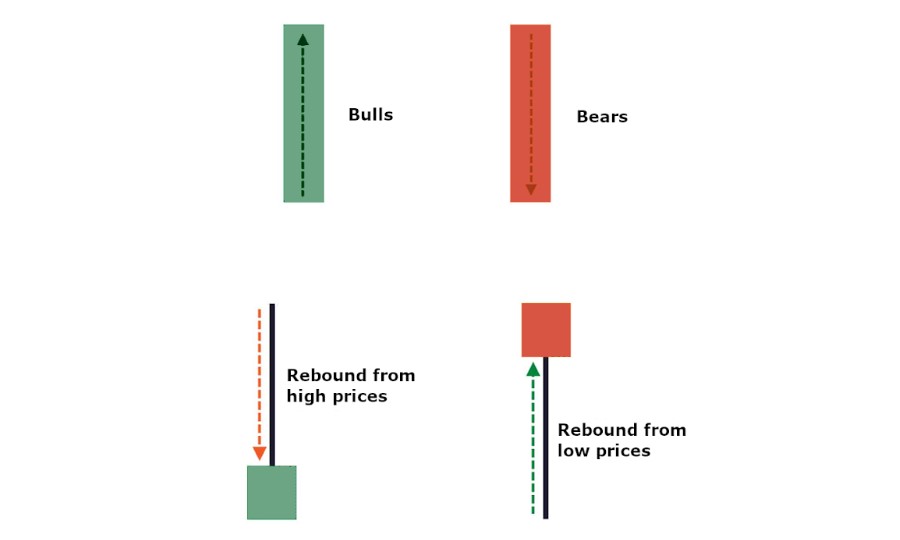

After the beginning of the candle, the battle between bulls and bears begins. If the buyers are stronger, you will see the candle move up and form a bullish candle. If the sellers are stronger, you will see the candle drop down and become bearish.

Bullish Candles

A bullish candle means there is currently buying pressure in the market. As long as there are more buyers, the candles will be bullish. If the buying pressure decreases and the selling pressure increases, we will see the bullish candles get smaller. This indicates a weakening of the power of buyers.

If the body of the candle is large, it is a strong bullish candle. If the body is small, it is a weak bullish candle. The candle not only shows us the current price - it tells us that at the moment the bulls are in control and there are more buyers than sellers in the market. This is important information.

If your trading strategy gives you a signal to go short, but the candle is clearly bullish, it may be a good idea not to enter any trades for now. Or wait a while until more sellers appear on the market.

Bearish Candles

The bearish candle tells us that there is more selling pressure in the market at the moment. As long as there are more sellers, the candles will be bearish. If the selling pressure decreases and the buying pressure increases, we will see the bearish candles get smaller. This indicates a weakening of the power of sellers.

If there are more sellers than buyers in the market, going long might not be the best idea.

Candle Shadows

In addition to displaying candle highs and lows, candle shadows provide us with a lot of useful information.

A small lower shadow, a small bearish body and a larger upper shadow. This candle tells us that at some point the bulls were trying to push the price up. This is what the long upper shadow tells us. However, before the candle closed, the bears took over and pushed the price back down. Therefore, the body of the candle is bearish.

Big lower shadow, small bullish body and small upper shadow. This candle tells us that at some point the bears tried to push the price down. This is what the long lower shadow tells us. However, before the candle closed, the bulls took over and pushed the price back up.

How to Read and Understand Japanese Candlesticks

We can think of price action in the financial markets as a battle between buyers and sellers.

- If there are more buyers than sellers, or the buying interest is higher, the price continues to rise. The price rises until it becomes so high that sellers find it attractive again.

- If there are more sellers than buyers, prices will fall until the balance is restored and more buyers enter the market.

- The greater the imbalance between these two market players, the faster the market will move in the same direction.

- When the interests of buyers and sellers are in balance, there is no reason for the price to change. Both parties are satisfied with the current price and the market is in balance.

- Any price analysis is aimed at comparing the strengths of both sides and assessing who currently controls the situation in the market and in which direction the price is more likely to move.

The color of the candle will tell us who is in control - bulls or bears.

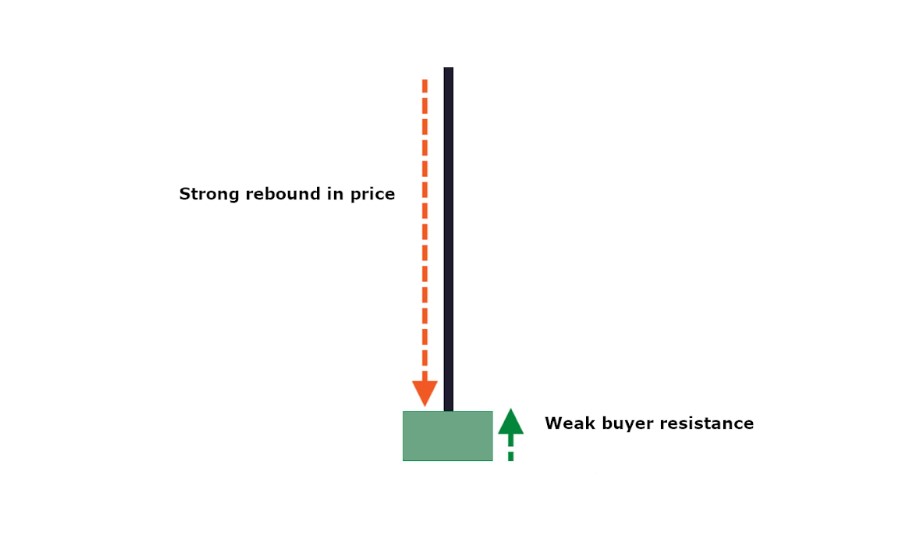

The length of the tail shows us the strength of the price rebound from a certain level.

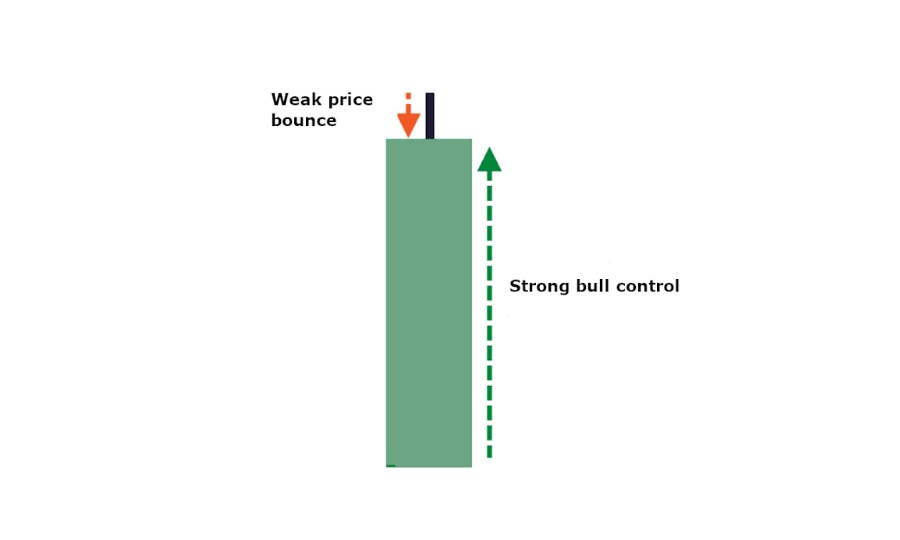

Body size shows us the power of buyers or sellers. For example, a large candle without shadows tells us that the bulls are in full control of the price and the buying pressure is minimal.

The long shadow of the candle tells us about a strong price rebound and selling pressure. Even though the candle itself is bullish, overall the sellers are much stronger.

By combining these three factors, we can fully interpret Japanese candlesticks on a chart.

It is not necessary to memorize all candle patterns. The main thing is to understand the structure of the candle. Namely:

- Body size.

- Shadow length.

- The ratio of the size of a candlestick's body to its shadow.

- Body position.

Body size

The size of the candle body shows the difference between the open and close price and tells us about the strength of buyers or sellers.

- A long candlestick body, which leads to a rapid rise in prices, indicates a rapid increase in buying interest and strong price movement.

- If the size of the bodies of candles increases, then the price movement along the trend accelerates.

- When the size of the bodies decrease, it may mean that the prevailing trend is coming to an end due to a more balanced ratio of buyers and sellers.

- Candle bodies that remain constant confirm the prevailing trend.

- If the market suddenly changes from long rising candles to long falling candles, this indicates a sudden change in trend and highlights a strong bearish trend. In this case, the reverse situation is also true.

Left: long bearish and bullish candles in the downtrend and uptrend phase. Lateral phases are usually characterized by smaller bodies.

Right: Long bullish and bearish candles are stronger in uptrends and downtrends. At the peak of the bull-bear balance, the price is characterized by smaller candles.

Shadow Length

The length of the shadows helps to determine the volatility, that is, the range of price fluctuations.

- Long shadows can be a sign of uncertainty because it means that buyers and sellers are in strong competition, but so far neither side has been able to gain an advantage.

- Short shadows indicate a stable market with little volatility.

- The length of candlestick shadows often increases after an uptrend phase. This indicates that the struggle between buyers and sellers is intensifying.

- Healthy trends that move quickly in the same direction usually show candles with small shadows as one side of the market players consistently dominates the market.

The Ratio of the Size of the Body of the Candle to its Shadow

- During a strong trend, candle bodies are often significantly longer than their shadows. The stronger the trend, the faster the price moves in the direction of the trend. During a strong uptrend, candles usually close near the high of the body and thus leave no shadow or only a small shadow.

- When the trend slows down, the ratio of buyers and sellers changes and the shadows of the candles become longer compared to the bodies.

- Consolidation phases and price reversals are usually characterized by candlesticks that have long tails and short bodies. This means that there is a relative balance between buyers and sellers, as well as uncertainty about the future direction of the market.

There are almost no shadows in the ascending phase, which confirms the strong trend. Long shadows are visible in the consolidation phase, which indicates uncertainty and increased struggle between buyers and sellers. When the shadows of the candles widen, it may herald the end of a trend.

Body Position

- If you see only one dominant shadow on one side and the body of the candle is on the opposite side, then this scenario is called a pin bar. The shadow indicates that although the price was trying to move in a certain direction, however, the opposite side of the market pushed the price strongly in the opposite direction.

- Another typical scenario shows a candlestick with two equally long shadows on both sides and a relatively small body called a Doji.

- On the one hand, this pattern may indicate uncertainty, but it may also indicate a balance between market players. Buyers tried to push the price up, and sellers tried to push it down. However, the price eventually returned to the starting point.

Japanese Candlestick Names and Types

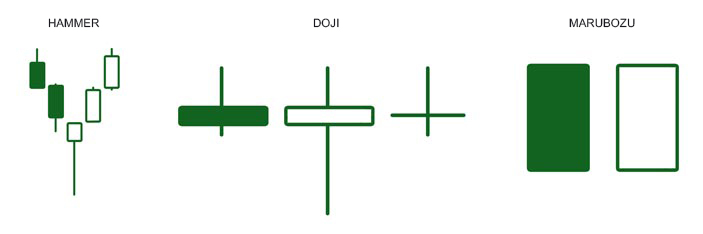

Some candles may have no shadows or body, or may only have one shadow. According to these factors, Japanese candlesticks are divided into:

- Ordinary candles (they do not have any anomalies in the formation, so to speak).

- Marubozu (long bodies without shadows).

- Doji (candle body looks like a line where the opening and closing prices are the same or very close).

Depending on the place of formation of Japanese candlesticks, despite the fact that they are similar, the names will be different. At the same time, there are candlestick patterns, the names of which do not depend on the place of their formation. According to these parameters, they can be divided into several groups:

- Reversal candles at the top of the trend.

- Reversal candles at the bottom of the trend.

- Candlestick patterns of trend continuation.

- Candlestick patterns, which can form both at the bottom and at the top of the trend, the name does not change from this.

Let's consider the most popular and most easy-to-define graphical models (patterns).

Candles Formed at the Top of a Trend

Now let's look at all of the above patterns with a description of the formation conditions and charts. Candlestick patterns formed at the top of a trend are usually preceded by a long directional move-up.

Shooting Star Pattern

A small candle body and one long shadow in the direction of the trend. The second shadow is very small or absent.

Hanging Man Pattern

Small body and one long shadow pointing down (against the direction of the trend). The second shadow is very small or absent.

Bearish Engulfing Pattern

The candlestick is larger than the previous one and completely covers it. Shadows in this case have a secondary role. As the name suggests, the candle called "Bearish Engulfing" should be of the opposite color compared to the previous candle.

Dark Cloud Pattern

A bearish candle opens with a gap (gap) and closes the gap, partially absorbing the previous candle.

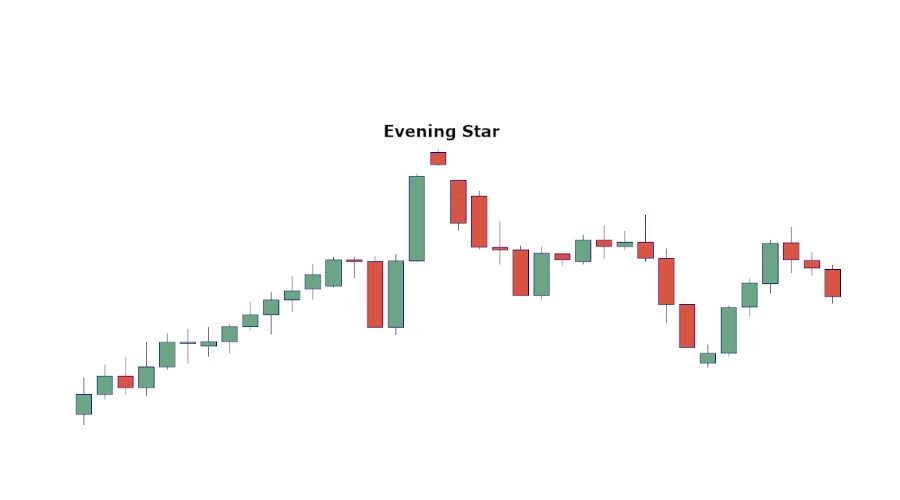

Evening Star Pattern

This pattern is formed by three candles. The extreme candles have a large body, the middle candle "Evening Star" has a small body, opens and closes with a gap .

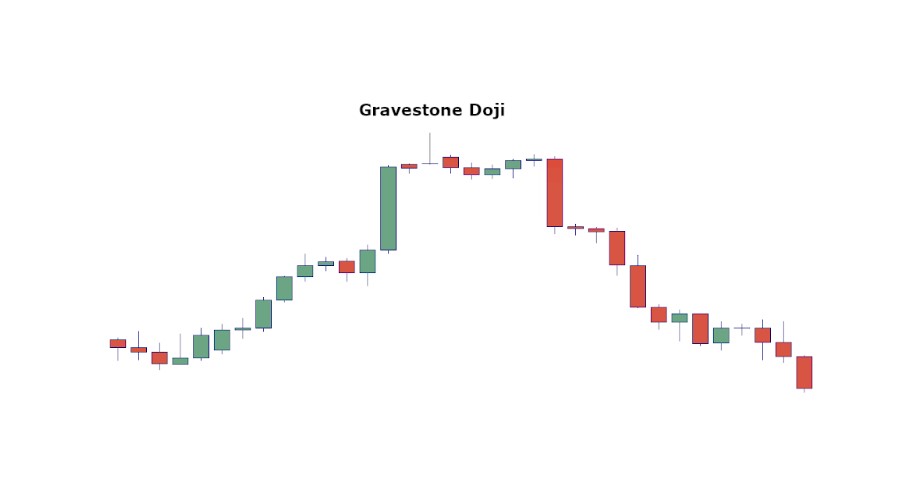

Gravestone Doji Pattern

The candlestick has no body at all (the opening and closing prices are at the same level) or it is very small, while the lower shadow is also absent.

Pattern Three Black Crows

Three candles with large bodies, directed against the main trend, located at the top of an uptrend.

Now let's look at the candlestick patterns that form at the bottom of a trend. As a rule, their formation is also preceded by a significant price movement, only this time down.

Hammer Pattern

It has a small body and a shadow directed towards the trend, in this case down. The second shadow is either small or absent. The "Hammer" is similar to the "Hanged Man" candlestick, with the only difference being that it forms at the bottom of the trend.

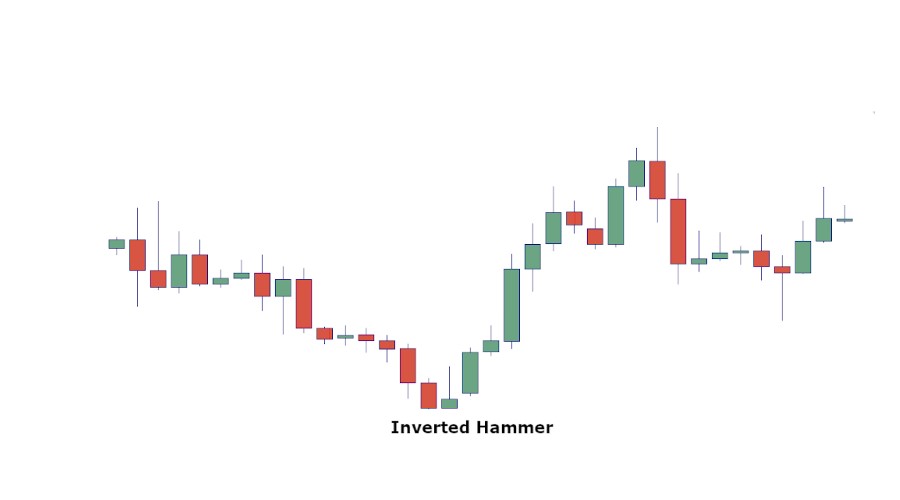

Inverted Hammer Pattern

A small candle body and one long shadow directed against the general trend. The second shadow is usually very small or absent. The "Inverted Hammer" is similar to the "Shooting Star" only formed at the bottom of the trend.

Bullish Engulfing Pattern

As in the "Bearish engulfing" the second candle completely closes the previous one, only in this case the candle is growing (bullish).

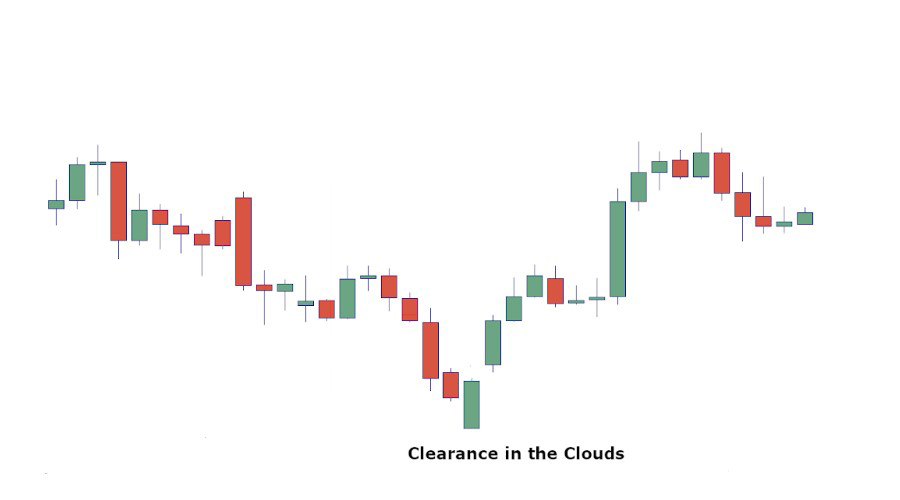

Clearance in the Clouds Pattern

The opening of the candle occurs with a gap down, after which the gap is covered with a partial absorption of the previous candle. The close of the candle should be above the middle of the previous candle. The lower shadow is absent or very small.

Morning Star Pattern

Extreme candles with large bodies, the middle candle with a small body is open and closed with a gap. The color of the candle does not matter.

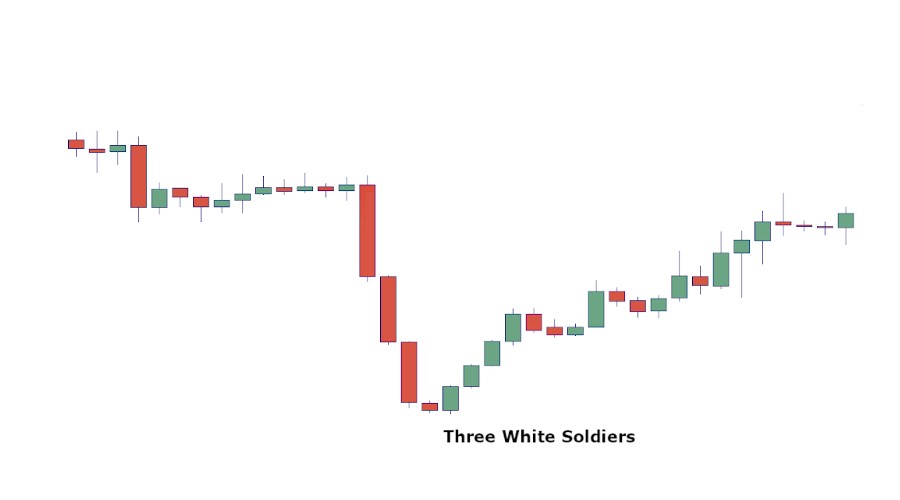

Pattern Three White Soldiers

After a decline at the bottom of the trend, three candles with large bodies are formed in a row directed against the main trend (upward candles).

Now let's get acquainted with the patterns, the appearance of which on the charts portends the continuation of the existing trend.

Candlestick patterns of trend continuation - Usually these candle combinations form a correction of the main trend and consist of several candles.

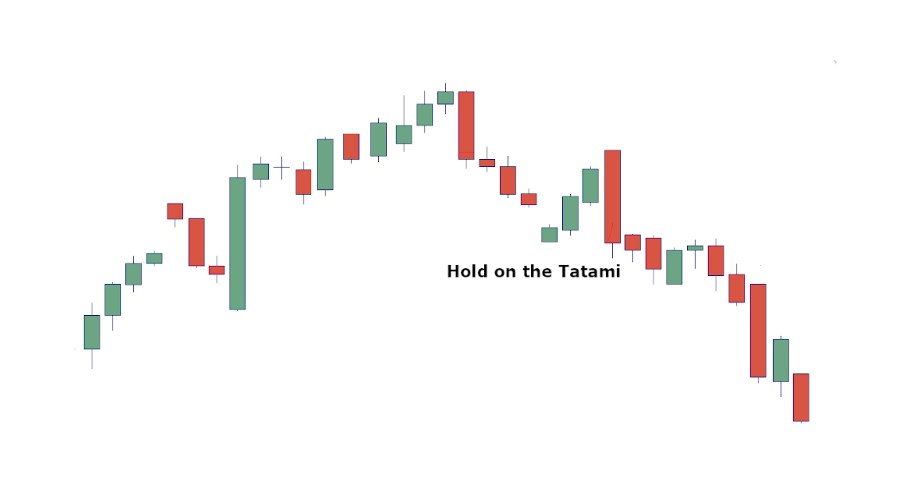

Pattern Hold on the Tatami

Correction of three candles, the first candle opens with a gap, the next two completely cover the gap. The fourth candle absorbs the previous ones and closes at a new high/low. As a rule, this candle combination is formed in the middle of a trend and in some cases gives a false signal for a reversal.

Tasuki Gap Pattern

After the formation of a price gap, the price makes a slight correction of candles of the opposite color and partially covers the gap. The current trend continues.

Pattern Triple Strike

A candle combination also consists of several candles. After a long directional movement, the price rolls back one large candlestick, which absorbs the three previous candlesticks with its body.

Next, we will consider patterns that have the same name, when formed at the top of the trend and at the bottom.

Graphic patterns at the bottom and at the top with the same name

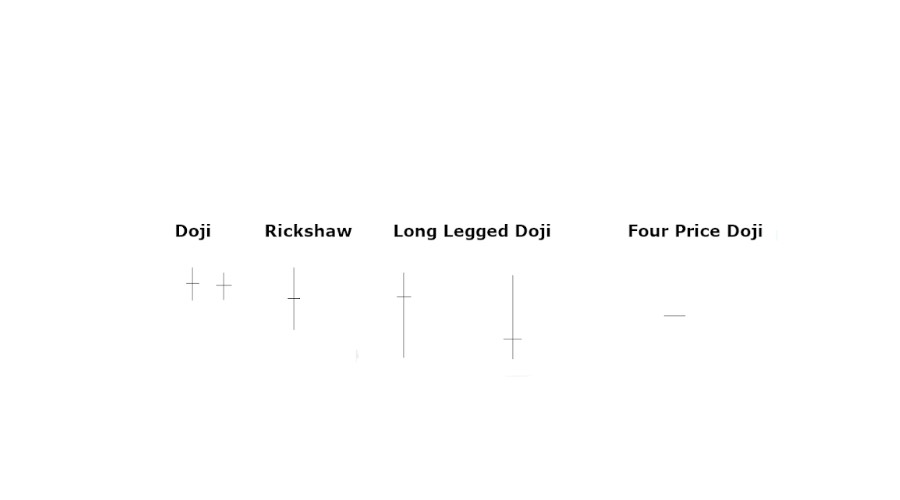

- Doji Patterns, Rickshaw, Long Legged Doji, Four Price Doji

- Tweezers

- Harami

- Harami cross

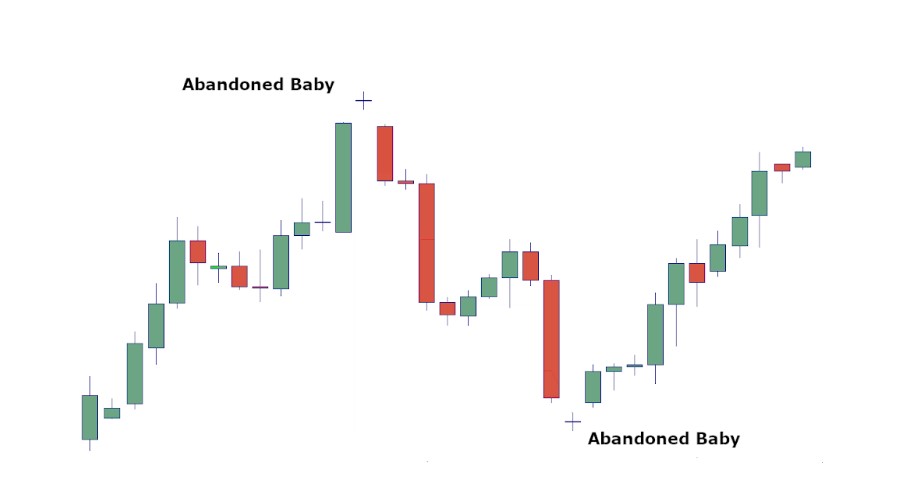

- Abandoned baby

Doji, Rickshaw, Long-legged Doji, Doji of four prices are varieties of Doji, but with some features. The Doji pattern has no body, the opening and closing prices are the same, but depending on the shadows, the name changes, although the essence does not change. Doji is a fairly strong reversal pattern.

Doji Pattern

Has little Shadows.

Rickshaw Pattern

Long shadows and the body is located in the middle (symmetrically).

Long Legged Doji Pattern

Long shadows, while the body is located closer to either the maximum value or the minimum (not symmetrically).

Four Price Doji Pattern

The opening price, closing price, high and low are in the same place.

Pattern Tweezers

Two candlesticks with approximately the same body size and very long shadows, the maximum or minimum values of which are the same (depending on the place of formation). Candle bodies of the opposite color.

Harami Pattern

The body of the second candle is completely hidden inside the previous one, including the shadows. The greater the difference between the size of the bodies of the candles, the stronger the reversal signal can be considered. The Harami Cross pattern can also be attributed here, only instead of the usual small candlestick there will be a Doji.

Abandoned Baby Pattern

Doji formed with a gap. The model will be strengthened by two conditions, the first candle before the Doji is growing, the next after, the Doji is falling. On a downtrend, the opposite is true.

Japanese Candlestick Trading

Now that we've looked at the individual elements, we can put it all together and see how we can use our knowledge of Japanese candlesticks in trading by analyzing price charts.

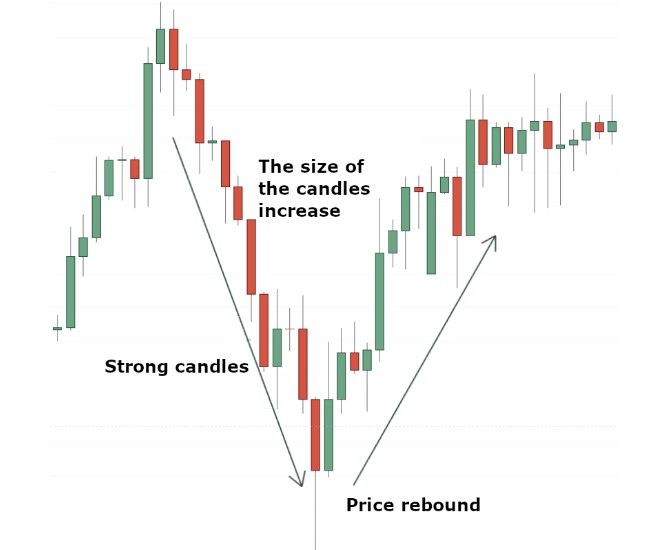

- During a downtrend, candles are only bearish and long with very little or no shadows at all – this indicates the strength of the sellers.

-

Below we see a price rebound. This is not enough to cause a reversal, but then we start to see strong bullish candles.

- The trend moves with strong bearish candles and no bullish candles at all.

- Then the bodies get smaller and the shadows get longer, indicating that the momentum is fading.

- The price returns to the previous support level, which is now becoming resistance, and we see a small bounce candle.

- At the support, we see that the candles are getting smaller and have more shadows, which confirms the indecision in the market. It also makes a breakdown of the support level unlikely.

-

Just before the support level is broken, price is just starting to form bearish candles and we can see momentum building up.

- During an uptrend, the candles are very long and only have very small shadows.

- Then we see two long shadows at the bottom. This shows that the price was trying to move lower, but it did not have enough selling pressure.

- Candles become even smaller after a failed sell-off attempt, which indicates that the trend is running out.

-

Then, all of a sudden, we see a strong bearish candle that confirms a new downtrend.

Japanese Candlestick Trading Examples

Now that we have studied forex reversal candles and their patterns, we can find potential trades on the chart. However, candlestick patterns are not traded separately. We must take into account the current context of the entire graph. Candles should always rest on something. These can be support or resistance levels in sideways markets or moving averages in trending ones.

Remember, no need to think that forex candles are the holy grail, and these formations will always work - it's wrong. So never forget to limit your losses and control your risks ( risk management).

Bottom Line on Japanese Candlestick

It is rather difficult to cover all candlestick combinations within one article. Candlestick analysis in the financial markets has been used for a very long time and watching the charts, market participants make their conclusions and perhaps they do not coincide with the observations that were made at the dawn of the analysis of Japanese candlesticks. There is no limit to perfection in development.

On the one hand, Japanese candlesticks and their formations may seem quite complicated at first glance, but having understood everything, it will become a powerful tool in your price movement forecasts. You don't need to memorize candlestick patterns to understand price action.

On your path to becoming a professional and profitable trader, it is essential that you start thinking outside the box and avoid common rookie mistakes. Japanese candlesticks will tell you how the price can move further, depending on who is in control at a given time - bulls or bears. However, you cannot use candles in trading in isolation. Always consider the market context.

FAQs

How does Forex Work?

Forex (Foreign Exchange) is a huge network of currency traders, who sell and buy currencies at determined prices, and this kind of transfer requires converting the currency of one country to another. Forex trading is performed electronically over-the-counter (OTC), which means the FX market is decentralized and all trades are conducted via computer networks.

What is Forex Market?

The Forex market is the largest and most traded market in the world. Its average daily turnover amounted to $6,6 trillion in 2019 ($1.9 trillion in 2004). Forex is based on free currency conversion, which means there is no government interference in exchange operations.

What is Forex Trading?

Forex trading is the process of buying and selling currencies at agreed prices. Most currency conversion operations are carried out for profit.

What is The Best Forex Trading Platform?

IFC Markets offers 3 trading platforms: MetaTrader4, MetaTrader5, NetTradeX. MT 4 Forex trading platform is one of the most downloaded platforms which is available on PC, iOS, Mac OS and Android. It has different indicators necessary for making accurate technical analysis. NetTradeX is another trading platform offered by IFC Markets and designed for CFD and Forex trading. NTTX is known for its user-friendly interface, reliability, valuable tools for technical analysis, distinguished functionality and the opportunity to create Personal Composite Instruments (PCI) which is available specifically on NetTradeX.