- Education

- About Forex

- What is Forex Market

What is Forex Market?

I think each of you has heard the word "Forex" - advertising of brokers with promises of earnings follows us everywhere. This word has an ambiguous reputation among the people, and some even consider Forex to be something like a casino. In fact, this is a global interbank foreign exchange market, where anyone can enter into transactions. Today we will analyze what Forex is, how it works, what are the ways to make money, foreign exchange and currency pairs.

KEY TAKEAWAYS

- Forex is an interbank foreign exchange market that is not tied to a specific place and has almost completely gone to the Internet.

- Forex trading is the exchange of one currency for another, and the price at which the exchange takes place is called the exchange rate.

- Spreads are usually small on large venues where large volumes of crypto assets are rotated daily. Much also depends on the liquidity of the currency itself.

- The Forex market provides many opportunities for investing online. You can trade on your own, or you can entrust it to a professional or even a program - everything is in your hands.

Forex Market Meaning

The market began to take shape in the 1970s. The refusal of all world powers from the gold standard in 1976 served as the basis for the creation of Forex. Since that time, countries have switched to the Jamaican system. Exchange rates began to depend on market relations, and not to be established by the state, as it was before.

Such a development of events contributed to the normal functioning of the world economy. The exchange of capital between different countries became fully possible. Today, the daily and increasing over time turnover of the international trading platform is from 5 to 7 trillion dollars.

Forex is an international global market. Currencies are the commodity here. It is quite acceptable to compare this market with an exchange office, in which one monetary unit is bought or sold for another.

For example, if it is known in the near future that the price of the US dollar will rise, then this circumstance can be used to make a profit by buying US currency and reselling it at a favorable price. Financial transactions in the international market occur in a similar way, but with larger amounts.

Forex provides an opportunity to make a profit thanks to the exchange rate difference. The exchange rate is usually understood as a unit of one currency, expressed in units of another. When the demand for any of the currencies falls, it becomes cheaper. Therefore, another monetary unit begins to be in great demand, and its price rises. You can earn both on falling prices and on their growth.

What is Foreign Exchange

Forex is an interbank foreign exchange market that is not tied to a specific place and has almost completely gone to the Internet. In fact, this is a huge online exchanger, where millions of market participants exchange one currency for another.

Forex market turnover reaches several trillion dollars a day. Despite this, the largest foreign exchange market in the world has earned us a controversial reputation due to the rampant fraud among brokers in the zero. All of them successfully went bankrupt or scammed, and mostly reliable companies have survived to this day.

The Forex market has many differences from the classic exchanges. The main thing is that it does not have a single place of trade; in a day, London, New York, Tokyo, Sydney and several other major cities in the world manage to become the main trading centers. According to the time of activity of a particular region of the globe, the working day is divided into four trading sessions in the foreign exchange market:

Each trading session is superimposed on others, so three more subsessions can be distinguished: Asia-Pacific, Euro-Asian, Euro-American. During overlays, there are a lot of traders involved in the market and strong movements often occur. The availability of Forex 24/5 opens up great opportunities for making profitable deals. Traders can go beyond one trading session and use all 24 hours to implement their strategies, even at night.

Millions of people and financial organizations participate in the huge multi-level system of the Forex market. Among which are central banks, commercial banks, investment funds, companies, brokers and private traders.

To earn more on the forex market, you need to use Forex leverage, and Forex brokers provide it.

What is Currency Pair

Forex trading is the exchange of one currency for another, and the price at which the exchange takes place is called the exchange rate. You are perfectly familiar with this concept, as you probably follow the dollar exchange rate.

Each Forex currency is indicated by a three-letter English combination, for example:

- USD - US dollar

- EUR - Euro

- GBP - British pound

- CHF - Swiss franc

- JPY - Japanese yen

- CAD - Canadian dollar

- AUD - Australian dollar

- NZD - New Zealand dollar

And the trading itself is carried out according to the quotes of currency pairs, which indicate the exchange process, for example EURUSD - the exchange of euros for dollars. The exchange rate of this pair is expressed in the amount of the second currency that must be given in order to exchange for a unit of the first.

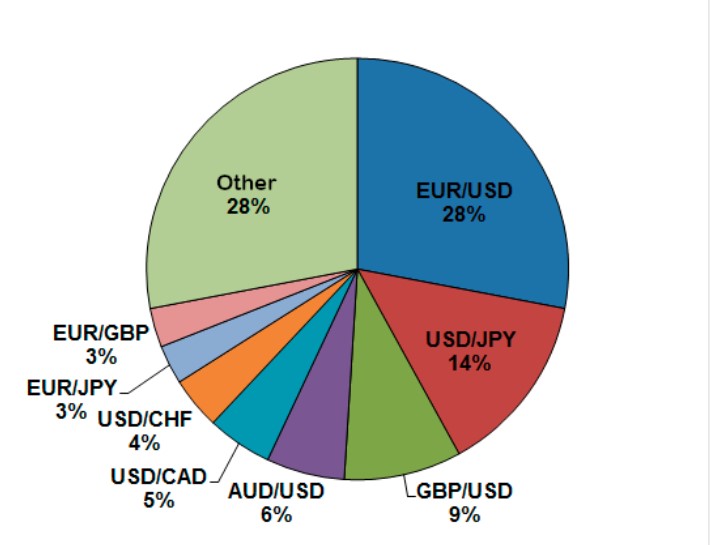

In total, more than 20 currencies are traded on the Forex market, which make up more than 70 traded currency pairs. Here are the most popular ones:

In recent years, Forex brokers have been actively adding trading in crypto assets: Bitcoin, Ethereum and other coins. Pairs with crypto are highly volatile and attractive to traders.

The exchange rate of a currency pair is constantly changing, as market participants around the globe make deals every second. The exchange rate at which the buyer and seller were able to agree is called a quotation, and information about it gets to other market participants through the global electronic system of interbank trading.

Bid, Ask Spread

Bid is the price that the buyer of an asset is willing to pay. Ask is the price at which the seller is willing to sell the asset. Spread - The difference between the ask and bid prices.

In simple words, in any market, the buyer names the price at which he is ready to buy something (bid), and the seller at which he is ready to sell something (ask). This is similar to the situation in the usual grocery market, when some haggler calls a lower price, and the seller defends a higher one. At the same time, both seek to maximize their profit.

The processes taking place on the crypto exchange are fundamentally no different from those described above, in a typical “bazaar” scheme. In most cases, the seller does not want to part with assets at the current, not the most favorable price for him, and prefers limit orders that are not executed immediately.

A trader who wants to buy a currency usually does not seek to do so at the current market price. He sets the bid price that is interesting for him, and the selling trader sets the ask price. In fact, there is a normal bargaining.

Spreads are usually small on large venues where large volumes of crypto assets are rotated daily. Much also depends on the liquidity of the currency itself.

Long and Short Positions

In the language of traders, a long position (‘Long’) is the purchase of an asset in anticipation of its price rising. A short position (‘Short’) is when a trader sells an asset in anticipation of a decline in its price.

Order Types

An order is an instruction created by the client to the exchange to carry out an operation to buy and sell cryptocurrencies under certain conditions.

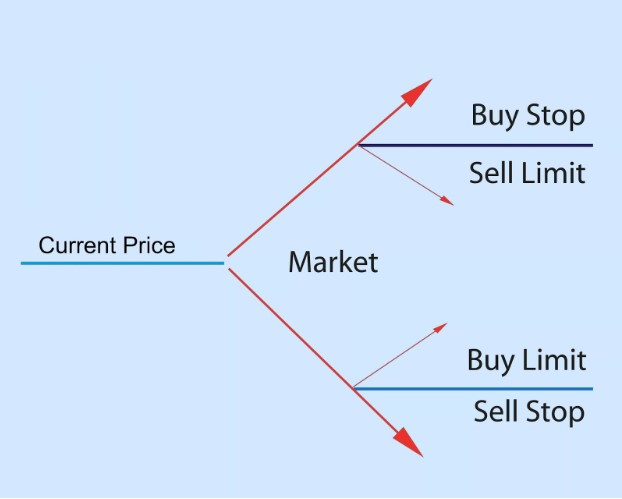

There are several types of orders used in stock trading. According to the type of execution, market, pending and limit orders are distinguished.

Market Order

Market Order is executed immediately after entering the exchange, at the best current price, if there is a corresponding reverse limit order for it.

For example, to execute a market order to buy (Market Buy), a limit order to sell (Sell Limit) is required. To execute a market order to sell (Market Sell), a limit order to buy (Buy Limit) is required. A market order to buy is executed at the Ask price, and a market order to sell is executed at the Bid price.

In other words, market orders are filled at the best price until the number of units of the asset at that price is exhausted (Order quantity).

Pending Order

Pending order is an order type, the opening parameters of which are set in advance.

A pending order is executed only when there are conditions for its execution. For example: the current market price is 8000 USD per 1 BTC. We place a Take Profit order - when the price reaches 10,000 USD, sell 1 BTC at a price of 9,990 USD.

This situation means that at the moment the limit order has not yet been formed on the exchange and it is not in the order book. However, it "hangs" in the trading terminal and waits for the moment when the price of the last transaction (last price) reaches 10,000 USD.

Limit Order

A limit order is an order to buy or sell a certain amount of an asset at a specified price.

For example, a trader bought 100 certain tokens for $20 each. He expects the market to continue rising and the coin will reach $25. Since the trader cannot (or does not want to) constantly monitor his positions, he decides to take profit at $24.50. To do this, he sets a limit order to sell 100 of these tokens. If their rate reaches $24.50, then the limit order will be executed and the trader will make a profit. Excluding trading commissions of the exchange, it will be:

100*(24.50-20)= $450.

A limit order can easily be filled immediately if there is a counter order at that price (essentially the situation is the same as with a market order).

A limit order to buy (Buy Limit)

This order is placed at a price that is lower than the current market price. The trader uses this order if he hopes that the price will first fall, and then, after rebounding from the support level, it will start to grow.

Limit Sell Order (Sell Limit)

Limit Sell Order (Sell Limit) - an order to sell at a specified price. Sell Limit is placed at a price higher than the current market price. Thus, a trader uses this order when he hopes that the price will first rise, but then, having reached a given level, it will turn around and start falling (i.e., he expects a rebound down from the resistance level).

Stop Order

A stop order is an order to buy or sell a certain amount of a cryptocurrency when its price reaches a certain level.

Stop Order to Buy (Buy Stop)

This order is to buy at a specified price or higher. The trader uses this order when he hopes that the rising price, having overcome the given resistance level, will still continue to grow. Buy Stop is set at a price that is higher than the current market price. As soon as the price of the last transaction becomes equal to or exceeds the price specified in the Buy Stop order, it immediately turns into a market order to buy. To trigger a Buy Stop order, the Ask price must be equal to or higher than the price specified in this order.

Stop Order to Sell (Sell Stop)

An order to sell an asset at a specified price or lower. The trader uses this order when he hopes that the price, with its downward movement, having reached a predetermined level, will continue to fall. Sell Stop is placed at a price that is lower than the current market price.

In other words, as soon as the price of the last transaction becomes equal to or less than the price specified in the Sell Stop, the order immediately turns into a market one. For the Sell Stop to be triggered, the Bid price must be equal to or less than the price specified in this order.

A stop order is used both to open a position and to exit it. In the latter case, the stop order is used as a protective order limiting losses (Stop Loss; stop loss). At the same time, the Buy Stop order provides hedging of a short position (sell), and Sell Stop - protection of a long position (purchase).

Also, any order on the exchange may not be fully executed, but partially (or even not executed at all). To execute an order, an opposite order is needed, but it may not be available at the current moment, or its size may not be enough for full execution. So, on the Bitfinex exchange, it is possible to place orders of the Fill-Or-Kill (FOK, “execute or cancel”) type.

Bottom Line on What is Forex Market

The Forex market provides many opportunities for investing online. You can trade on your own, or you can entrust it to a professional or even a program - everything is in your hands.

But whatever you choose, you need to understand at least in general terms what is Forex trading and how does it work. This will help you better understand where investment income comes from and invest money more efficiently. Without understanding the basics, it will be much more difficult to make money, investments in this case will clearly not be the way to spend money correctly - in fact, it will be an investment of funds “at random”, you will suddenly be able to earn money. But that doesn't happen most of the time.

FAQs

How does Forex Work?

Forex (Foreign Exchange) is a huge network of currency traders, who sell and buy currencies at determined prices, and this kind of transfer requires converting the currency of one country to another. Forex trading is performed electronically over-the-counter (OTC), which means the FX market is decentralized and all trades are conducted via computer networks.

What is Forex Market?

The Forex market is the largest and most traded market in the world. Its average daily turnover amounted to $6,6 trillion in 2019 ($1.9 trillion in 2004). Forex is based on free currency conversion, which means there is no government interference in exchange operations.

What is Forex Trading?

Forex trading is the process of buying and selling currencies at agreed prices. Most currency conversion operations are carried out for profit.

What is The Best Forex Trading Platform?

IFC Markets offers 3 trading platforms: MetaTrader4, MetaTrader5, NetTradeX. MT 4 Forex trading platform is one of the most downloaded platforms which is available on PC, iOS, Mac OS and Android. It has different indicators necessary for making accurate technical analysis. NetTradeX is another trading platform offered by IFC Markets and designed for CFD and Forex trading. NTTX is known for its user-friendly interface, reliability, valuable tools for technical analysis, distinguished functionality and the opportunity to create Personal Composite Instruments (PCI) which is available specifically on NetTradeX.