- Education

- About Forex

- How to Trade USDCAD

How to Trade USDCAD

The USDCAD pair is one of the major (most popular currency pairs in the Forex market) currency pairs.

The development trend of the Canadian stock market. The Canadian stock market is one of the most developed in the world. It is characterized by significant turnover of securities, high development of the stock market infrastructure and a variety of financial instruments.

The Canadian dollar is a popular trading currency, accounting for about 6% of transactions in international trade. Many of the world's leading powers keep some of their foreign exchange reserves in Canadian dollars. Thanks to free conversion and good volatility, the Canadian dollar is one of the seven most popular currencies traded on Forex.

Let's consider the factors affecting its quotes and the main methods of trading this instrument and how to trade USDCAD.

KEY TAKEAWAYS

- USDCAD is a forex ticker symbol for the exchange rate between the US dollar and the Canadian dollar. It tells traders how many Canadian dollars are needed to buy one US dollar in real time.

- The price of the Canadian dollar is influenced by a number of fundamental factors that affect the supply and demand for the currency.

- The Canadian dollar is not a major reserve currency in the world. Despite the fact that Canada belongs to highly developed countries, its national currency remains regional and belongs to raw materials.

Canadian Dollar Trading

The Canadian dollar is the national currency of Canada, known by its abbreviation CAD. It is consistently one of the eight most traded currency pairs in the world.

USDCAD is a forex ticker symbol for the exchange rate between the US dollar and the Canadian dollar. It tells traders how many Canadian dollars are needed to buy one US dollar in real time.

The pair is consistently among the top 10 most traded currency pairs in the world, and as such, traders can count on good liquidity and tight spreads.

Since the pair is linked to both the US and Canadian economies, traders should be aware of developments that could affect each, such as the policies of the Federal Reserve and the Bank of England, and interest rate differentials between central banks. Also, due to the CAD's correlation with commodities like oil and its USD pricing, it's useful to watch the price of oil to see where the USDCAD might go next.

CAD is one of the world's commodity currencies, the Canadian dollar is affected by changes in the price of coal, ferrous and non-ferrous metals. And the biggest influence is exerted by the movement of oil prices, so the change in the exchange rate of this currency is quite easy to predict, because the energy market is easily predicted. Just look at historical data for the past year.

What Moves the Canadian Dollar

The price of the Canadian dollar is influenced by a number of fundamental factors that affect the supply and demand for the currency.

Monetary Policy

When central banks seek to curb excessive inflation, they often consider raising interest rates to encourage the economy to save more than spend and reduce the rise in prices of goods and services. In turn, higher interest rates attract foreign investment, in this case increasing the demand for the Canadian dollar and raising its value against other currencies.

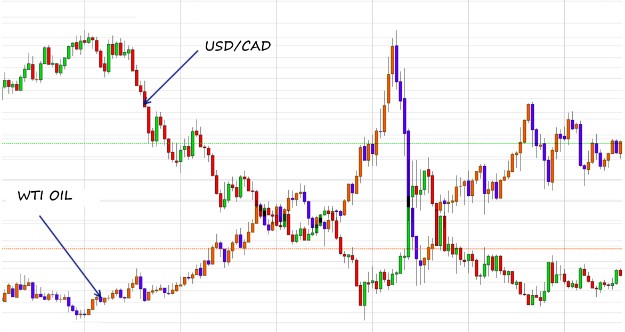

Oil Prices

Oil prices are closely linked to the strengthening of the Canadian dollar, especially in the USDCAD currency pair, due to Canada's status as one of the world's largest oil producers and the pricing of this commodity in US dollars. When a large amount of oil flows from Canada to the US, demand is created for Canadian dollars, which leads to a rise in the CAD and often a decline in the USDCAD pair.

The high oil price also means higher Canadian dollar export earnings, which also boosts the Canadian dollar. Conversely, lower demand and lower prices reduce the inflow of the US dollar into Canada, lowering the value of the Canadian dollar and having a bullish effect on the USD/CAD pair. An example of this was the collapse in oil prices in March 2020, when the Canadian dollar, in turn, fell against a number of currencies.

Of course, the balance of trade covers a range of other commodities as well as commercial and manufactured goods, so traders interested in CAD should keep abreast of how other key Canadian sectors develop over time.

Economic Data Releases/News Events

The release of data can influence fundamental analysis, which in turn can inspire traders to take positions in certain currencies. For example, inflation as measured by the consumer price index can affect interest rates, as discussed above, meaning that traders can expect rapid inflation to cause rates to rise, resulting in more demand for CAD.

Other metrics to watch out for are sentiment, consumer confidence, which can be a guide to the direction of the economy, retail sales, services and manufacturing PMIs, and GDP itself, the definitive measure of economic activity.

How to Trade USDCAD

When working with this currency pair, you need to consider the following:

- Technical analysis works, but false breakouts are not uncommon on USDCAD. The chart can make a throw beyond the level, but instead of fixing to it and continuing to move, it returns below the level. Right at the moment of the level breakdown, it is better not to trade, but to wait for a full-fledged fixation behind the support/resistance.

- Indicator and graphic methods of analysis also work.

- It is better not to use the correlation factor with oil in intraday trading. At short time intervals, the correlation may be broken and the processing of entry points will not be the best.

- The pair is convenient for trading, but only for traders whose daily routine allows them to capture the European and American trading sessions.

- Analytics based on the wave approach and other methods with a high degree of subjectivity is not the best choice for trading. Due to the subjective factor in the same market segment, different traders will come to different conclusions.

The Canadian dollar is not a major reserve currency in the world. Despite the fact that Canada belongs to highly developed countries, its national currency remains regional and belongs to raw materials. CAD has been and remains a slave pair with USD, the forecast for the near future shows that the situation will not change.

As for trading instruments, the USDCAD pair is available not only in the Forex market. You can work with binary options on it, futures and options contracts are also available. Regardless of the chosen instrument, the charts are the same, they can be tracked online and make sure that the quotes match up to 4 decimal places.

If you want to analyze the course movement for this pair, you can do it on the USDCAD live chart.

Here is a universal chart for monitoring changes in the exchange rate of currency pairs, with this tool you can see the dynamics of price movement in real time or analyze the behavior of the trend in the past.

The trend movement is displayed in the form of candles, which allows you to more effectively assess the market situation for the selected asset.

You do not need to look for a chart for each individual pair, just select the required currency pair in the settings and set the time interval.

When trading the USDCAD pair, traders can use the following methods:

Fundamental Analysis

Any fundamental analysis of the loonie (Canadian dollar) begins with the state of the US economy. Historically, the Canadian dollar followed the dynamics of the US dollar for quite a long time (inverse relationship), but starting around 2002, the Canadian dollar has grown strongly against the American and other international currencies.

However, the main consumer of Canadian raw materials and goods remains the United States and Japan. In addition to the oil of its fundamental data, the dynamics of the pair depends on many external factors, the difference in interest rates between the Fed and the Bank of Canada, foreign exchange interventions of the US dollar and the Japanese yen.

USD/CAD is actively reacting to economic statistics and the political situation in the United States, as well as natural disasters. The economic state of the United States puts quite a lot of pressure on the volume of imported raw materials into the country, so it is important to track the US dynamics of GDP, sales of residential buildings and the business activity index.

During periods of global economic uncertainty, loonies are strongly stimulated by external capital inflows. During periods of high prices for basic goods, investors are always actively investing in the Canadian dollar, so any political instability favorably affects its rate.

Technical Analysis

For the Canadian dollar, medium and long-term trend, as well as non-speculative channel strategies for a breakdown work stably. Despite the fact that USDCAD is considered a very technical pair and trades mainly with the trend, it is difficult for beginners to work with it due to its speculative volatility and the need to monitor commodity markets.

It is especially dangerous that the main USDCAD pair during non-US sessions has frequent false breakouts of significant levels. The period of greatest activity and maximum volumes for USDCAD fall on the American session, and on the most popular CAD/JPY cross - in the middle of the Asian session (Japan) and the beginning of the European one.

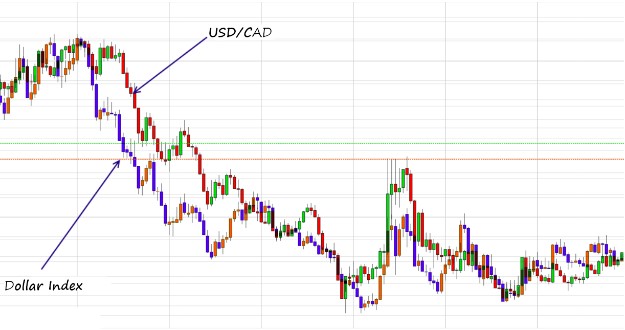

Trading on Correlations

At the moment, the Canadian dollar clearly demonstrates the fact that the correlation of trading assets is a temporary phenomenon. The country's economy is changing, traditional correlations no longer work, but new ones are emerging. While Canada is in the top 10 in gold and industrial silver mining, market correlations with these metals vary.

An important factor in the development of the country is export, or rather its direction: 80-83% of Canadian exports are to the United States - which is why Canada is especially interested in the growth of the American economy. This interest is expressed in the inverse correlation between USD/CAD and US stock indices. However, in Forex, the correlation with the dollar index is rather weak:

The strongest and most usable remains the correlation of the main pair with the prices of oil and oil products. It is oil that traditionally outperforms the USD/CAD pair and works as an indicator that shows the direction of transactions in CAD. An increase in the price of oil causes a fall in the USD/CAD pair, but still, the most convenient reaction for trading is shown by the CAD/JPY cross.

Those who want to reduce the risks of forex transactions can use the correlation between oil prices and the CAD rate through other financial instruments, such as exchange-traded funds (ETFs).

Bottom Line on How to Trade USDCAD

The proximity and community of business interests of the USA and Canada provides a constant flow of money from country to country, which has a significant impact on the foreign exchange market. Which contributes to volatility, and the latter contributes to speculation.

Forex traders can benefit from any factors that affect the volatility of an asset, and the only condition for the normal trading of the Canadian dollar - tight money management - is dictated by the connection with oil. Almost all technical indicators on the Canadian dollar behave in a standard way.

FAQs

How does Forex Work?

Forex (Foreign Exchange) is a huge network of currency traders, who sell and buy currencies at determined prices, and this kind of transfer requires converting the currency of one country to another. Forex trading is performed electronically over-the-counter (OTC), which means the FX market is decentralized and all trades are conducted via computer networks.

What is Forex Market?

The Forex market is the largest and most traded market in the world. Its average daily turnover amounted to $6,6 trillion in 2019 ($1.9 trillion in 2004). Forex is based on free currency conversion, which means there is no government interference in exchange operations.

What is Forex Trading?

Forex trading is the process of buying and selling currencies at agreed prices. Most currency conversion operations are carried out for profit.

What is The Best Forex Trading Platform?

IFC Markets offers 3 trading platforms: MetaTrader4, MetaTrader5, NetTradeX. MT 4 Forex trading platform is one of the most downloaded platforms which is available on PC, iOS, Mac OS and Android. It has different indicators necessary for making accurate technical analysis. NetTradeX is another trading platform offered by IFC Markets and designed for CFD and Forex trading. NTTX is known for its user-friendly interface, reliability, valuable tools for technical analysis, distinguished functionality and the opportunity to create Personal Composite Instruments (PCI) which is available specifically on NetTradeX.