- Education

- About Forex

- Forex Trading Times

Forex Trading Times - Forex Market Times

Forex trading, also known as foreign exchange trading, is a decentralized market where the world's currencies are traded. This means that the forex market is open 24 hours a day, five days a week, and operates in different time zones around the world. With its vast liquidity and potential for high returns, forex trading is a popular financial market for traders of all levels of experience.

In this article, we will explore the forex trading times and the best time to trade forex. We'll also discuss the most active trading hours and what you need to know about trading during different market sessions.

KEY TAKEAWAYS

- The forex market is open 24 hours a day, five days a week, and operates in different time zones around the world.

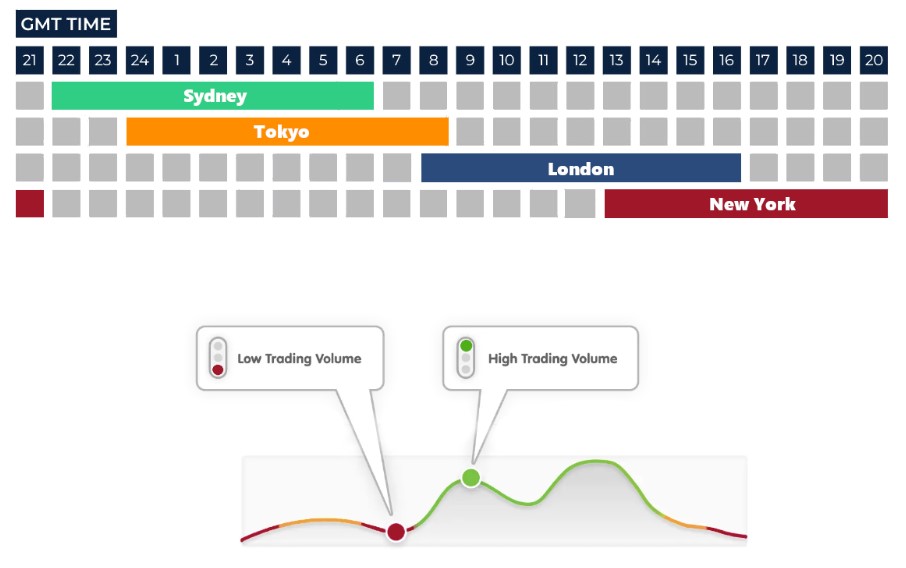

- The forex market is divided into four major trading sessions: the Sydney session, the Tokyo session, the London session, and the New York session.

- The best time to trade forex is during the overlap of two trading sessions, particularly between the London and New York sessions.

- During the most active trading hours, traders can expect high liquidity and volatility, which can result in significant profits or losses.

Forex Trading Times

The forex market is open 24 hours a day, five days a week, starting from Sunday evening (22:00 GMT) until Friday evening (21:00 GMT). This means that traders have the opportunity to trade currencies around the clock, making forex trading one of the most accessible financial markets in the world.

However, not all trading sessions are equal, and it is important to understand the forex market hours and how they affect trading. The forex market is divided into four major trading sessions: the Sydney session, the Tokyo session, the London session, and the New York session. These sessions overlap at certain times, resulting in increased liquidity and volatility in the forex market.

The Sydney Session: The Sydney session opens at 22:00 GMT and closes at 07:00 GMT. It is the least active session of the forex market and is mainly dominated by traders from Australia and New Zealand.

The Tokyo Session: The Tokyo session opens at 00:00 GMT and closes at 09:00 GMT. It is the first major trading session to open, and it is dominated by traders from Japan. It is also the most active session in the Asian market, with high liquidity and volatility.

The London Session: The London session opens at 08:00 GMT and closes at 17:00 GMT. It is the most active trading session in the forex market, with the majority of trading volume coming from Europe. During this session, traders can expect high liquidity and volatility in the market.

The New York Session: The New York session opens at 12:00 GMT and closes at 21:00 GMT. It is the last major trading session to open and is dominated by traders from the United States. The New York session is also one of the most active sessions, with high liquidity and volatility.

Best Time to Trade Forex

The best time to trade forex is during the overlap of two trading sessions. During these times, there is an increase in trading volume and volatility, resulting in more trading opportunities and potential profits.

The most significant overlap occurs between the London and New York sessions, from 12:00 GMT to 17:00 GMT. During this time, traders can expect high liquidity and volatility, making it the best time to trade forex.

To maximize your trading opportunities during these times, it is important to have access to a reliable trading platform. MetaTrader 4 (MT4) is a popular trading platform among forex traders due to its advanced charting tools, trading indicators, and expert advisors. You can download MT4 from IFC Markets website.

Most Active Trading Hours

The most active trading hours in the forex market are during the London and New York sessions. During these times, traders can expect high liquidity and volatility, which can result in significant profits or losses. It is important to understand that trading during high volatility can be risky, and it is crucial to have a solid trading plan and risk management strategy in place.

Below you can see when most active trades are happening:

To determine the most active trading hours for Tesla stock if you are living in Toronto (Canada), you would need to add GMT-4 hours to the trading hours of the NASDAQ exchange in the United States.

This would allow you to overlap your local time with the trading hours of the exchange, which can increase the likelihood of more trading activity and higher liquidity in the market, making it easier for you to buy or sell Tesla stock at your desired price.

It's important to keep in mind that the stock market is always unpredictable and involves risks, so it's crucial to do your own research and consult with a financial advisor before making any trading decisions.

It's important to know when the forex market is most active. During the weekdays, there's always at least one trading session open, but let's be real - some of these can be real, it's extremely boring. If you want to make some serious money, you should wait for trading sessions to overlap.

Why, you ask?

Simple - when two major financial centers are open at the same time, the number of traders actively buying and selling a given currency greatly increases. This means you're more likely to get a good deal and make some sweet profits.

So when's the best time to trade?

The answer is during the overlap of the London and New York trading sessions. More than 50% of trading volume occurs at these two financial centers, making it the prime time to get in on the action. You can see it from the image above.

Bottom line on Forex Trading Times

Forex trading is a 24-hour market, and understanding the forex trading times is crucial for successful trading. The forex market is divided into different trading sessions, each with its own characteristics and trading opportunities. The most significant overlap occurs between the London and New York sessions, making it the best time to trade forex.

While trading during high volatility can be profitable, it can also be risky. It is important to have a solid trading plan and risk management strategy in place to minimize potential losses. It is also essential to have access to a reliable trading platform, such as MetaTrader 4, to make the most of trading opportunities during high volatility.

In addition to understanding the forex trading times, traders should also be aware of important economic news releases that can impact the forex market. Major news events, such as central bank announcements, can cause significant market movements and affect currency values. It is important to stay up-to-date with economic news and events to make informed trading decisions.

Furthermore, traders should also consider the trading hours of their preferred currency pairs. While some currency pairs may be more active during certain trading sessions, others may have lower trading volumes and be less volatile. Traders should choose currency pairs that align with their trading strategy and preferred trading times.

In conclusion, understanding the forex trading times is crucial for successful forex trading. The best time to trade forex is during the overlap of two trading sessions, with the most significant overlap occurring between the London and New York sessions.

Traders should have a solid trading plan and risk management strategy in place, as well as access to a reliable trading platform. By staying up-to-date with economic news and events and choosing currency pairs that align with their trading strategy, traders can maximize their trading opportunities and potential profits in the forex market.