- PAMM accounts

- What is IFCM Invest

- What is PAMM Account

What is PAMM Account

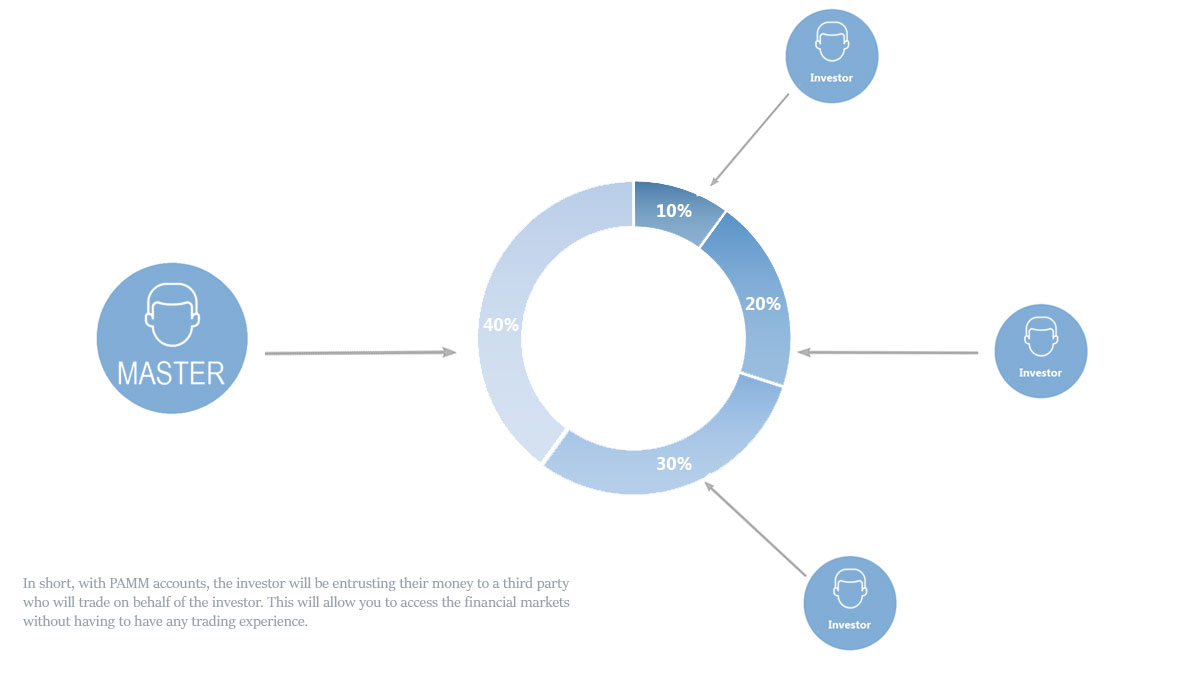

In short, with PAMM accounts, the investor will be entrusting their money to a third party who will trade on behalf of the investor. This will allow you to access the financial markets without having to have any trading experience.

It is important to note that PAMM account traders will always invest their own money in an investment portfolio as this provides them with financial motivation to trade without risk. In exchange for their efforts, PAMM traders receive a commission on any profit made for investors. This commission is charged before investors personal profit is realized.

KEY TAKEAWAYS

- In short, with PAMM accounts, the investor will be entrusting their money to a third party who will trade on behalf of the investor.

- PAMM is a form of investment in which traders who have proven themselves in profitable trading offer their services in managing investors' funds, as well as their own, within a single portfolio account.

- PAMM accounts are constantly exposed to the same risks as in individual trading. Thus, risk management is still necessary and always remains relevant.

What is PAMM Account

PAMM is a form of investment in which traders who have proven themselves in profitable trading offer their services in managing investors' funds, as well as their own, within a single portfolio account. All profits and losses resulting from trading activities on this account are divided between the manager and investors in accordance with the percentage of capital that each of them contributed to the common pool.

Thus, PAMM is a relationship between an experienced trader working as an account manager and an inexperienced investor who has access to a pool of funds that can be exchanged for money. Trading is a very exciting and costly activity.

IFCM Invest is a service with PAMM technology. PAMM or Percentage Allocation Management Module is a trading system that allows Investments. Start investing and take a bite of trillions of dollars that pass through the financial markets.

What is PAMM Trading

In PAMM trading, the role of the investor is to provide capital for trading on the account. That is, the execution of trades depends on the money manager, who trades at his own discretion within a set of broader parameters specified by the investor.

Investor knowledge requirements are significantly reduced when using a PAMM account for Forex trading.

The role of a broker when opening a PAMM account is usually to provide a link between the fund manager and the investor. It is also possible that they may work on behalf of a broker.

Fund manager usually takes a commission for transactions, and in some cases applies a fixed fee for his services. The broker in the relationship is also usually entitled to a lower fixed fee or commission.

Investors in turn can use a number of tools that brokers provide to monitor the state of their accounts and track any trades made by their authorized manager.

Is PAMM Trading Profitable

PAMM accounts as any trading servies contains risk, but it is profitable, no doubt. One of the advantages is that investors will not have to worry about their trading strategy because that will be handled by a professional.

Plus the profits an individual investor makes are correlated to the percentage of capital everyone contributes to said account. Someone who contributed 30% of the total money in the account, will be awarded 30% of the profits made at the end of the month. So at no point will other investors take away your earnings from your capital invested. The only losses the investor is not insured are losses related to the performance of the trader in charge of the account.

It's a very straightforward way to make money in the forex market. So, don't hesitate to strat.

Bottom line on PAMM Account

You already know that the best PAMM accounts allow their investors, regardless of their trading experience, to profit from trading without monitoring the markets, conducting analysis and spending their time and effort.

To summarize, in the PAMM account system, clients give permission to money managers to trade in financial markets on their behalf.

Which has several advantages, such as the ability for investors to earn passive income without having to watch the markets on a daily basis.

But do not forget that PAMM accounts are constantly exposed to the same risks as in individual trading. Thus, risk management is still necessary and always remains relevant.