- Analytics

- Trading News

- Biden Blocks $14.9 Billion Nippon Steel Deal

Biden Blocks $14.9 Billion Nippon Steel Deal

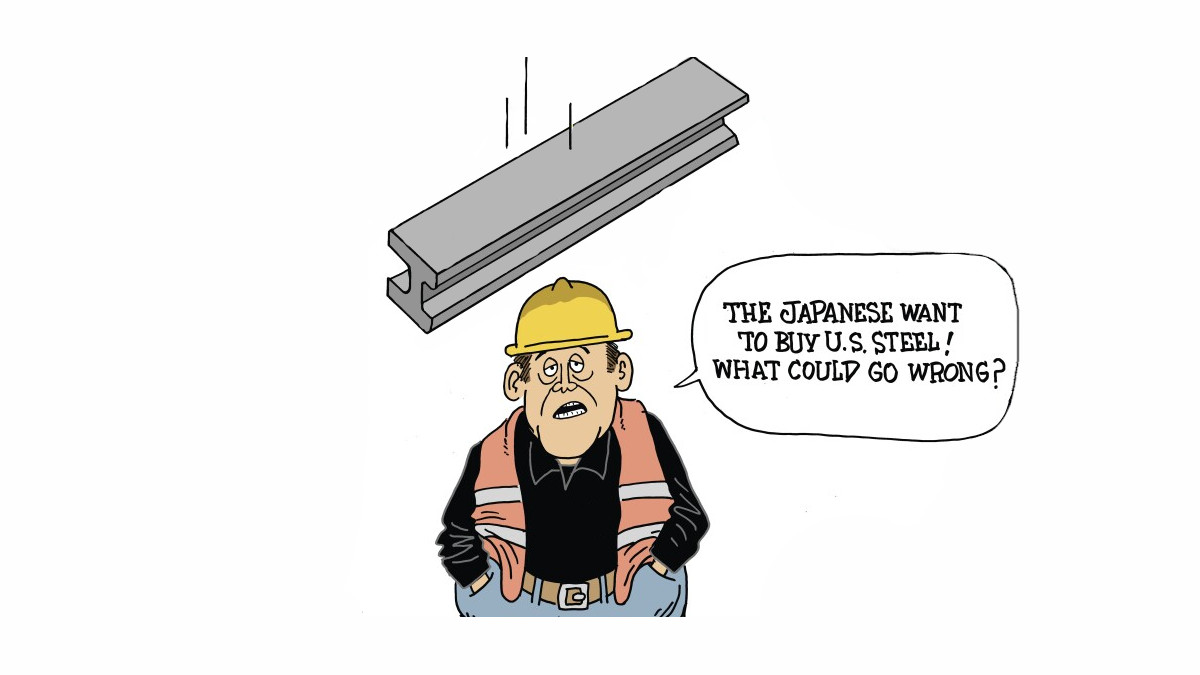

President Joe Biden has stepped in to block Nippon Steel’s $14.9 billion deal to buy U.S. Steel. The government is saying it’s about protecting national security, but this move has stirred up a lot of drama. There’s backlash, legal threats flying around, and people are starting to question what’s really driving America’s trade decisions. Let’s break it down and get to the real story.

The Heart of the matter is that Nippon Steel, Japan’s biggest steelmaker, was set to merge with U.S. Steel, which would’ve created the world’s third-largest steel company. After a year of back-and-forth with CFIUS, they couldn’t agree internally, so it ended up on Biden’s desk. And surprise—he said no. The official reason? “National security concerns.” But let’s be real: slapping a “security issue” label on this feels more like a cover for economic nationalism than any real threat.

U.S. Steel’s execs are ringing alarm bells, saying plants could close and jobs could vanish if the deal falls through. The United Steelworkers union isn’t buying it. They’ve called those warnings nonsense, arguing U.S. Steel is still financially strong enough to weather the storm.

If you look at U.S. Steel’s books, it doesn’t exactly scream difficult situation. Yeah, profits have been sliding for nine quarters, but this isn’t a company circling the drain. So, are these dramatic warnings just a way to scare the public into supporting the deal?

As for the union, their message is simple: keep U.S. Steel American. But let’s not ignore the practical side of their position. It’s not just about waving the flag—it’s about protecting their own turf. Dealing with an American company is a lot easier for them than trying to negotiate with a foreign HQ halfway around the world.

Nippon Steel’s Next Move

Nippon Steel isn’t backing down. They’re considering legal action, claiming Biden’s decision was unlawful. The plan? Challenge the CFIUS process. But here’s the catch: CFIUS operates largely in the dark, and legal experts say lawsuits against it almost never succeed.

This lawsuit talk might be less about actually winning and more about optics and leverage. At best, Nippon Steel could force some internal disagreements over the deal to come to light. At worst? They walk away with a $565 million breakup fee and little else to show for it.

What’s Next for U.S. Steel

With this deal dead, U.S. Steel has to regroup. Cleveland-Cliffs, which bid earlier ($7.3 billion - two times less), could re-enter the picture with a lower offer. But Cliffs’ own market value has dropped, so it’s unclear if they even have the funds to pull it off. Another potential buyer? Nucor.

There’s also buzz that the U.S. government might jump in, providing support to U.S. Steel as part of a “save American industry” push. Politically, that would be a hit. But in terms of addressing U.S. Steel’s actual challenges? That’s a whole different question.

U.S.-Japan Relations

This veto doesn’t just impact the steel industry—it’s a direct hit to U.S.-Japan ties. Japan is the biggest foreign investor in America and a key ally against China. From Tokyo’s perspective, this move likely feels like a betrayal, undermining a partnership the U.S. claims to prioritize.

Trade expert Wendy Cutler pointed out that alienating Japan contradicts the goal of strengthening competitiveness against China. And with Trump coming back—a guy known for throwing tariffs at allies—Japan might be bracing for more tension.

What’s Really Going On

- The “national security” excuse looks more like an economic shield for domestic industries.

- Both Biden and Trump are more focused on winning headlines about “saving jobs” than fixing the deeper issues plaguing U.S. Steel.

- Turning Japan into collateral damage could hurt U.S. alliances at a time when teamwork against China matters most.

- Nippon Steel’s legal threats seem more like a power play than a serious shot at overturning the decision.

The Bottom Line

Biden’s veto may look good to unions and nationalist voters, but it raises bigger questions: What’s the actual plan for U.S. Steel’s future? How does alienating Japan help long-term trade or security goals? And when will real solutions take the place of easy headlines?