- Analytics

- Technical Analysis

Gold vs. USD Technical Analysis - Gold vs. USD Trading: 2017-07-03

Earlier shift to monetary policy tightening weighs on gold prices

Improved global growth prospects and earlier shift to monetary tightening by central banks is bearish for gold. Will gold price continue falling?

The shift to monetary tightening by central banks earlier than previously believed weighs on gold price. European Central Bank President Mario Draghi said the ECB could adjust its policy tools of sub-zero interest rates and massive bond purchases as economic prospects improve in Europe last Tuesday. In the UK the Bank of England Governor Carney suggested on Wednesday that there’s a limit to the BOE’s tolerance for above-target inflation. Bank of Canada Governor Poloz said the same day that the Canadian economy enjoyed “surprisingly” strong growth in the first three months of 2017 and he expected the pace to stay above potential. US Q1 GDP was upgraded to 1.4% from 1.2% also improved US growth performance. And Federal Reserve appears on course for another hike this year as its plans also to start reducing its balance sheet. A shift to tightening bias in world’s biggest central bank is bearish for gold.

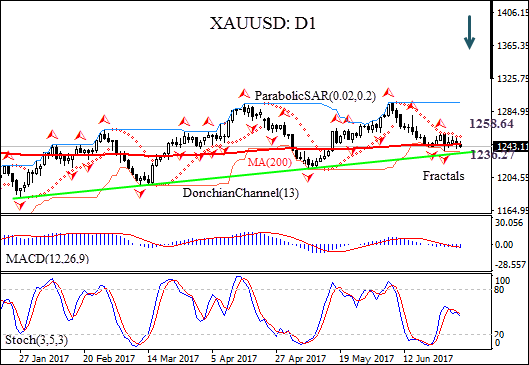

The XAUUSD: D1 has fallen below the 200-day moving average MA(200) on the daily chart, and soon will test the support line of the uptrend.

- The Parabolic indicator gives a sell signal.

- The Donchian channel indicates no trend yet: it is flat.

- The MACD indicator is below the signal line and the gap is widening, this is bearish.

- The stochastic oscillator is falling but has not reached the oversold zone.

We believe the bearish momentum will continue after the price closes below the lower Donchian boundary at $1236.27, supported by the fractal low. A pending order to sell can be placed below that level. The stop loss can be placed above the fractal high at $1258.64. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. The most risk-averse traders may switch to the 4-hour chart after the trade and place there a stop-loss moving it in the direction of the trade. If the price meets the stop loss level ($1258.64) without reaching the order ($1236.27), we recommend canceling the position: the market sustains internal changes which were not taken into account.

Technical Analysis Summary

| Position | Sell |

| Sell stop | Below 1236.27 |

| Stop loss | Above 1258.64 |

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.