- Analytics

- Technical Analysis

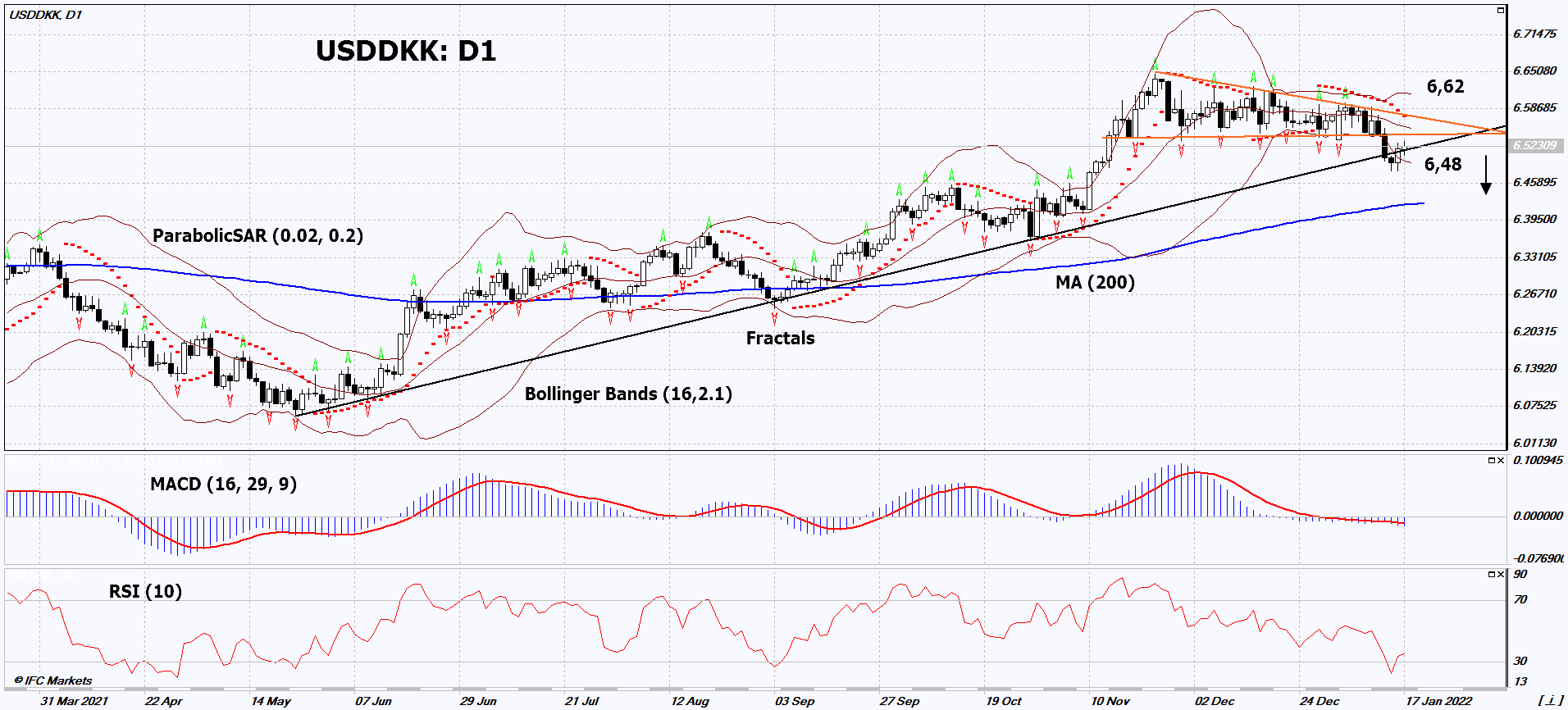

USD/DKK Technical Analysis - USD/DKK Trading: 2022-01-18

USD/DKK Technical Analysis Summary

Below 6.48

Sell Stop

Above 6.62

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Sell |

| MA(200) | Neutral |

| Fractals | Neutral |

| Parabolic SAR | Sell |

| Bollinger Bands | Neutral |

USD/DKK Chart Analysis

USD/DKK Technical Analysis

On the daily timeframe, USDDKK: D1 exited the triangle and broke down the uptrend support line. A number of technical analysis indicators formed signals for further decline. We do not rule out a bearish movement if USDDKK: D1 falls below the latest low and lower Bollinger band: 6.48. This level can be used as an entry point. The initial risk limit is possible above the last 3 upper fractals, the upper Bollinger band and the Parabolic signal: 6.62. After opening a pending order, we move the stop following the Bollinger and Parabolic signals to the next fractal maximum. Thus, we change the potential profit/loss ratio in our favor. The most cautious traders, after making a trade, can switch to a four-hour chart and set a stop loss, moving it in the direction of movement. If the price overcomes the stop level (6.62) without activating the order (6.48), it is recommended to delete the order: there are internal changes in the market that were not taken into account.

Fundamental Analysis of Forex - USD/DKK

Denmark released positive economic data. Will the decline in USDDKK quotes continue?

The downward movement means the Danish krone is strengthening against the US dollar. In November, Denmark's trade balance and current account balance increased, as well as increased industrial production. In addition, inflation in December fell to 3.1% y/y from 3.4% in November. In addition, the strengthening of the Danish krone may contribute to the dissatisfaction of the authorities with negative rates on deposits. Theoretically, this could be followed by their increase. Now the deposit rate Danmarks Nationalbank (Danish Central Bank) is -0.6%. The Danish Financial Supervisory Authority believes that the negative rates are unreasonable fees for banking services and has addressed the issue to the European Commission. Recall that negative rates on deposits in Denmark have been in effect since 2012. Another positive for the crown could be the lifting of a significant part of the anti-coronavirus restrictions in Denmark.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.