Nvidia Stock Continue to Rally as CEO Completes Planned Share Sale

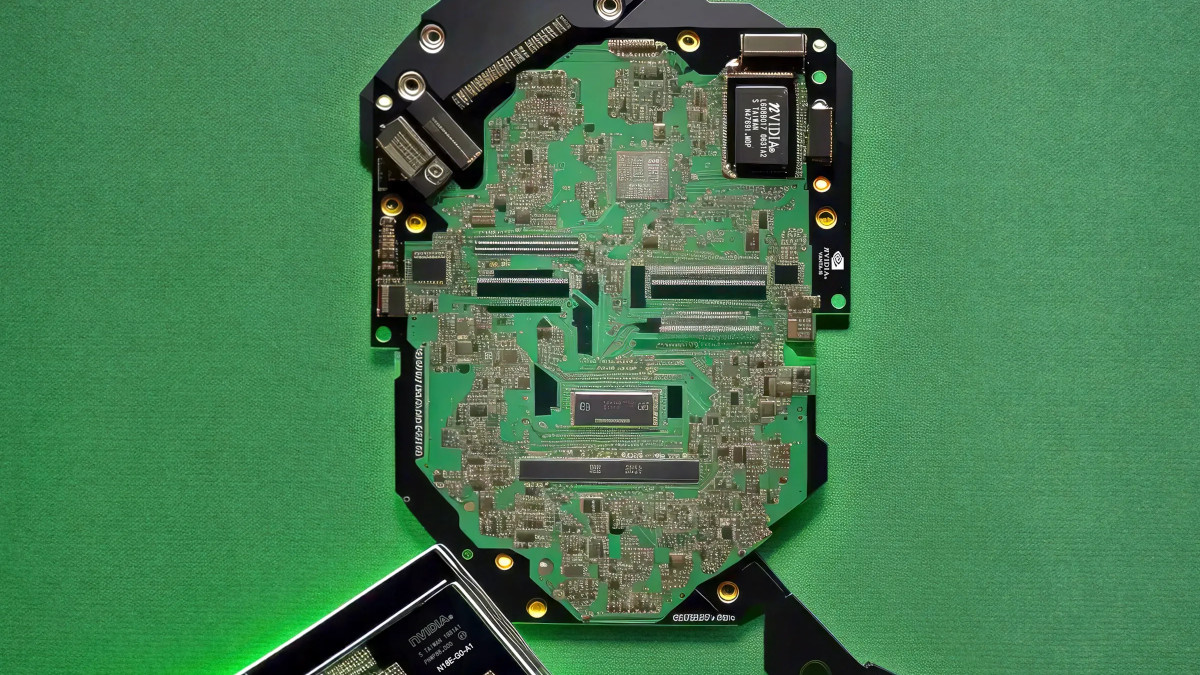

Nvidia’s stock is on an upswing after CEO Jensen Huang completed a planned stock sale, part of a prearranged Rule 10b5-1 trading plan. Huang sold 6 million shares, netting over $700 million. Despite the large scale of the sale, this pre-planned execution minimizes concerns about insider trading or opportunistic motives.

The sales, spread over several months from June to September 2024, were conducted in small portions, avoiding major disruptions to Nvidia’s stock price. Investors remain confident, as these sales were pre-scheduled and unrelated to any sudden changes in the company’s prospects.

Nvidia’s stock has surged over 100% in the past year, driven by booming demand for AI chips. The company’s strong financial performance, fueled by innovations in artificial intelligence, cloud computing, and gaming, created favorable conditions for Huang’s stock sales. The rising stock price allowed him to maximize returns, selling at higher prices than in earlier periods.

Market Reactions and Sentiment Analysis

Nvidia's stock rose by 2.18%, reflecting positive investor sentiment. This stock sale, paired with the company's ongoing uptrend, suggests confidence in its future growth. Broader indices like the NASDAQ have also been boosted by Nvidia’s strength in the tech sector.

Overall market sentiment is bullish, supported by Nvidia’s performance and optimism in the AI space. Huang’s stock sale has not dampened confidence, reinforcing the view that Nvidia remains well-positioned for continued success.

Actionable Insights

- Nvidia’s continued momentum may offer short-term trading opportunities, with investors betting on further gains.

- However, Huang’s stock sale might also be a cautionary signal for those considering locking in profits.

- Maintaining exposure to the AI and semiconductor sectors while diversifying within tech remains essential due to the high volatility but strong growth potential of these industries.

Bottom Line

Nvidia's CEO stock sale hasn’t hurt investor sentiment, with the pre-planned 10b5-1 sale executed smoothly and without market disruption. The company’s strong position in the AI chip market, along with the positive market response, signals continued bullishness.