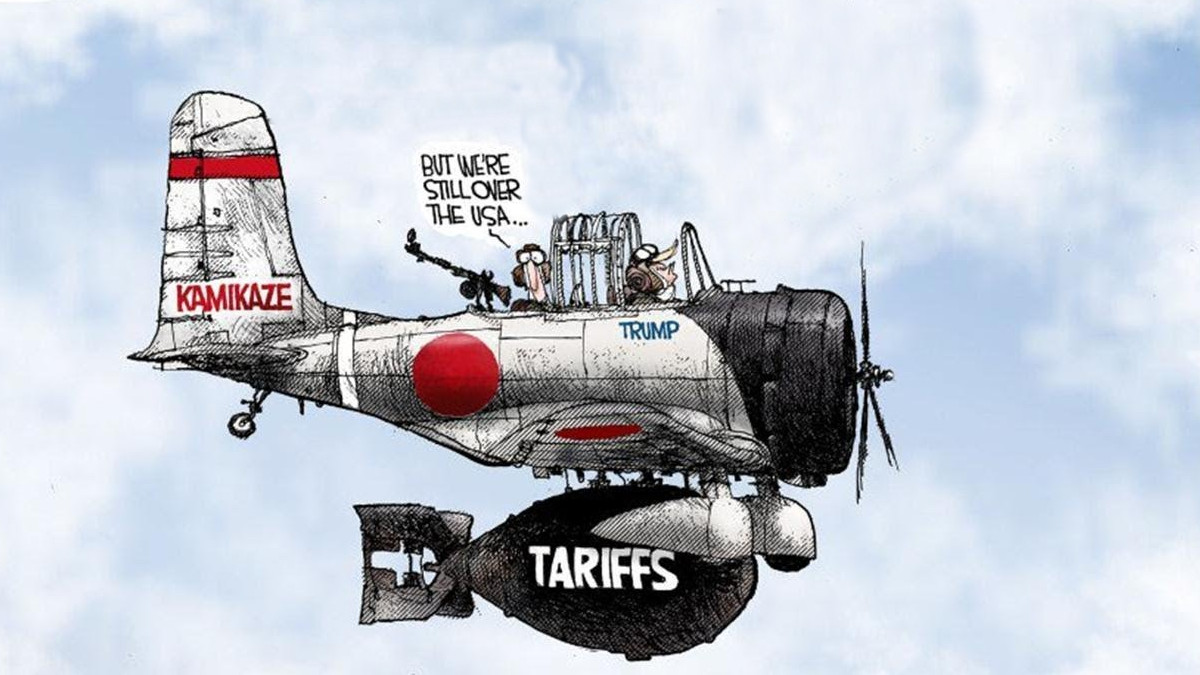

Walmart Has Been Hit Hard by Trump’s Trade War with China

Walmart, the largest retailer in the United States, has been hit hard by President Donald Trump’s trade war with China. The Trump administration imposed tariffs—taxes on imported goods—of 20% on all products coming from China, a move that has forced companies like Walmart to rethink their strategies. Walmart, known for its low prices, tried to make its Chinese suppliers bear the brunt of these extra costs. But the Chinese government had a different idea, and they’ve made it clear: they won't pay for the tariffs.

The Tariff Squeeze on Walmart

Walmart imports a significant amount of its products from China—an estimated 20% of its goods. As tariffs increased, Walmart began pressuring its Chinese suppliers to lower their prices by as much as 10% to keep costs down for American shoppers. However, China isn’t backing down. In response, Chinese officials stepped in, signaling their disapproval. Walmart executives were asked to meet with Chinese authorities to discuss the situation.

This is a crucial moment for Walmart. The company has always leveraged its size to keep prices low, but now, it's caught in the middle of an escalating trade war. On one hand, it risks upsetting U.S. customers if it raises prices. On the other, pushing Chinese suppliers too hard could damage its business relationships in China, where Walmart also has a strong presence.

The Bigger Picture: A Struggling Economy and Trade Tensions

The timing couldn’t be worse. U.S. consumers are already showing signs of financial strain, cutting back on travel, home improvements, and even food spending. Retail sales have been weaker than expected, which raises concerns that the U.S. economy could be slowing down or even heading toward a recession.

As tariffs hit U.S. retailers like Walmart, the stakes are higher. Consumers want low prices, but the trade war makes it harder to deliver on that promise. If Walmart, with all its power, struggles to keep prices low, smaller businesses will likely feel the pressure even more.

China’s Growing Influence and Walmart’s Strategy

Walmart may be big, but it’s not immune to China’s influence. The Chinese government’s intervention reveals the limits of Walmart’s bargaining power. While Walmart imports a lot from China, it also has suppliers in over 70 countries, and two-thirds of its products are made in the U.S. This means Walmart has options to diversify its supply chain, but China’s role remains critical.

What’s more, Walmart has a significant presence in China, where it owns the Sam’s Club warehouse chain. Last year, Walmart's sales in China grew by 16%, bringing in $17 billion. If the Chinese government continues to pressure Walmart, it could affect the company’s business there as well.

Despite these challenges, Walmart is in a better position than many smaller retailers. Its large scale and diverse supply chain give it some flexibility. But the trade war’s impact on consumer spending, along with China’s strategic leverage over suppliers, means Walmart will need to carefully navigate the ongoing tensions.

China’s Retaliation Against U.S. Companies

Walmart isn’t the only U.S. company feeling the heat from China. The Chinese government has also announced new retaliatory tariffs on U.S. agricultural imports, adding more strain to the trade relationship.

Additionally, China has targeted U.S. companies like Google and PVH (the parent company of Calvin Klein and Tommy Hilfiger), placing them on a blacklist and investigating their business practices.

These moves are part of China’s broader strategy to push back against U.S. tariffs and economic policies. For companies like Walmart, this creates a complicated situation, where political pressures are just as important as business decisions.

What’s Next for Walmart and the U.S. Economy?

Walmart’s struggle with tariffs shows just how complex the trade war between the U.S. and China is. The company’s size and influence aren’t enough to shield it from the effects of tariffs, and smaller retailers are likely feeling even more pressure. As consumer spending slows down and the retail industry faces uncertainty, Walmart’s ability to keep prices low while balancing its relationships with both the U.S. and Chinese governments will be crucial.

In the end, the trade war isn’t just about big retailers like Walmart. It’s about how much U.S. consumers will be willing to pay for products, and how businesses will adapt to a rapidly changing global economy. As tensions continue to rise, the next few months will be critical for Walmart and other companies trying to navigate this challenging landscape.